Transforming Google Pay with AI: Personal Finance Made Simple and Engaging.

Disclaimer

This case study is a conceptual project and is not affiliated with or endorsed by Google. The ideas and designs presented here are solely my own and are intended for educational and illustrative purposes only.

Context

Many young professionals struggle to manage their finances due to a lack of personalized tools and knowledge. They need integrated solutions for budget tracking, financial advice, and insights into their daily lives to make informed decisions and achieve their financial goals.

How Might We Solve This Problem?

There are numerous ways to address this issue, ranging from financial education programs and providing syllabuses to various digital and non-digital solutions. However, for this case study, Instead of developing new applications, integrating financial management features into Google Pay can leverage its large user base for seamless user experiences. Adding features from Gemini AI would provide personalized financial insights, enhancing Google Pay’s functionality.

Why Google Pay and Gemini AI?

Google Pay, with over a billion downloads, provides a familiar platform for financial transactions. Integrating Gemini AI’s advanced insights into Google Pay would create a holistic tool for personal finance, improving convenience and user engagement without needing a separate app.

Google Pay has several advantages

- Existing User Base: Google Pay already has a large, engaged user base, making it easier to introduce new features without needing to build an audience from scratch.

- Seamless Experience: Users benefit from having all their financial tools in one place, reducing the need to switch between multiple apps.

- Trust and Security: Google Pay is known for its robust security features, which can enhance user trust in new financial tools.

- Integrated Data: Combining transaction data with financial insights allows for more personalized and accurate recommendations.

- Convenience: Users already familiar with Google Pay’s interface may find it easier to adopt new features without learning a new app.

Possible business goals for this integration

- Increased User Engagement: Drive daily usage by offering valuable financial insights.

- Expand User Base: Attract users seeking comprehensive financial management tools.

- Monetization Opportunities: Introduce premium features or financial products for a fee.

- Cross-Promotion: Utilize other Google products for an integrated financial toolset.

Revised “HMW”?

How might we integrate Google Pay with Gemini AI to provide personalized financial insights, enabling users to effectively manage their budgets and make informed decisions intuitively?

Research

Objective

To validate the need for integrating personalized financial management features into Google Pay, aimed at young professionals in India, aged twenty to thirty, with basic financial knowledge.

Participants

Conducted surveys with 50 Google Pay and interviewed with 3 users aged 20–30 to identify pain points in current financial management tools.10 young professionals, ensuring a balance of genders, occupations, and financial habits.

Analysis

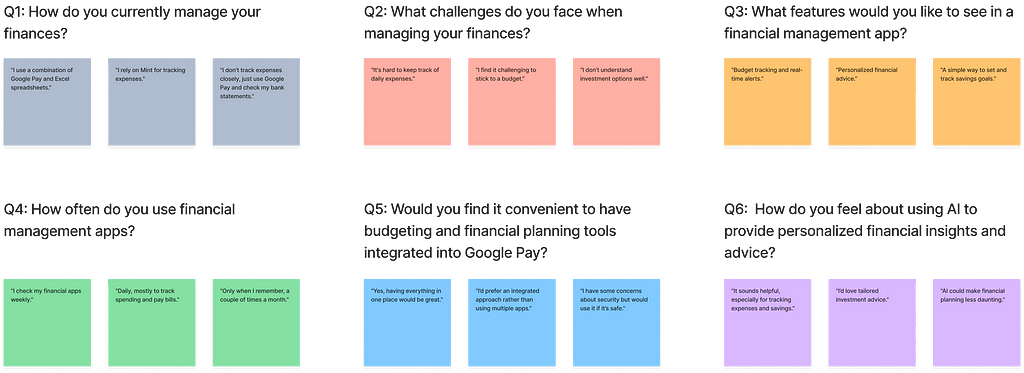

These are the main themes identified from answers from the users

- Need for Budget Tracking: The majority expressed a strong need for budget tracking and alerts.

- Desire for Personalized Advice: High interest in receiving tailored financial advice.

- Convenience of Integration: Users appreciated the idea of having financial tools integrated within Google Pay.

- Interest in AI: Positive reception towards AI, especially for personalized insights.

Key Findings

- 70% of users expressed a need for better financial tracking.

- 65% showed interest in AI-driven financial insights.

The research confirms a strong interest among young professionals in having integrated financial management features within Google Pay. Participants value budget tracking, personalized advice, and savings goals as the most desired features. AI-powered insights are seen as beneficial and align with user needs.

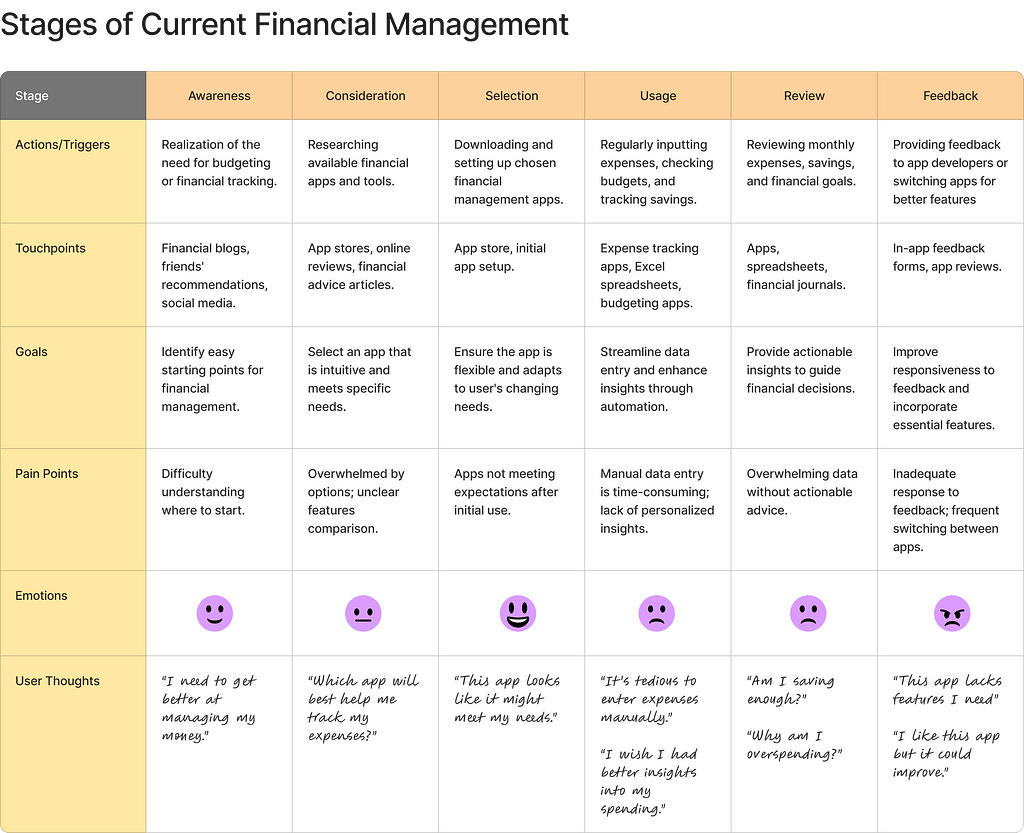

User journey mapping

This user journey mapping helps in understanding the current financial management landscape and sets the stage for integrating new features into Google Pay to improve user experience.

Pain Points Identified

- Manual data entry is time-consuming.

- Lack of personalized insights.

- Overwhelming financial data without actionable advice.

- Switching between multiple apps to manage finances.

Competitive Analysis

Objective

To evaluate the landscape of financial management apps to integrate new tools into Google Pay by identifying key features and user experiences.

Data Collection

Market Positioning

- Paytm: A versatile hub for payments and basic services.

- PhonePe: Broad financial services with a complex interface.

- Cred: Specializes in credit card management and rewards.

- YNAB: Appeals to strict budgeters with its focused approach..

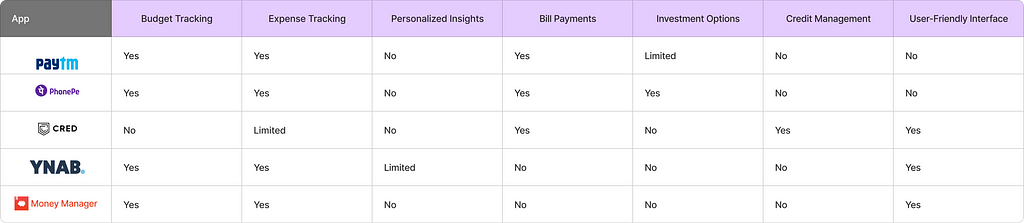

Feature Comparison Matrix

Analysis summary

- Google Pay + Gemini AI: Combines the convenience of daily transaction tracking with AI-driven financial insights, providing a seamless user experience unmatched by competitors.

By integrating comprehensive financial management tools into Google Pay, focusing on user experience, and leveraging AI for personalized insights, the app can effectively meet the needs of young professionals in India. This approach not only addresses existing gaps in the market but also provides a unique value proposition that sets it apart from competitors.

User persona

User personas help in shaping these designs by providing insights into specific user types. This document outlines two distinct personas: Riya Sharma and Arjun Mehta. Each persona represents a different segment of the target market, with unique backgrounds, financial habits, technology usage, and challenges.

Success Metrics

Here’s how I’d approach Success Metrics for Google Pay with Gemini AI, objectives might include:

- Enhance user understanding of financial information.

- Increase user engagement with personalized financial tools.

- Improve user satisfaction and retention.

Key Metrics

Based on these objectives, potential Success Metrics include:

- Task Success Rate: Percentage of users successfully using new financial tools.

- User Engagement: Frequency of interactions with personalized financial features.

- User Satisfaction: Measured through surveys or NPS.

- Cognitive Load Reduction: Assessed through time on task and user feedback.

- Retention Rate: Percentage of users continuing to use the new features over time.

- Feature Adoption Rate: Percentage of users who start using new features within a set period.

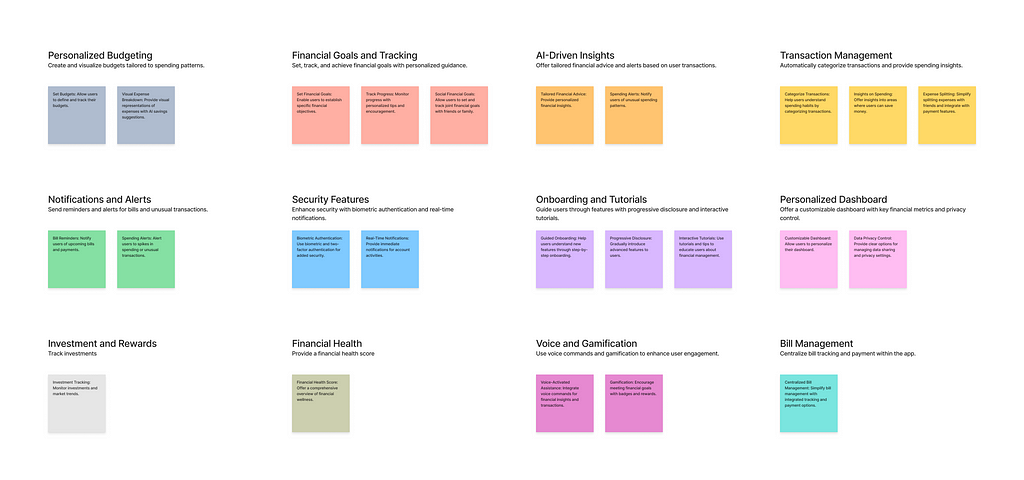

Feature Development

These solutions are designed to address the needs of young professionals who seek personalized financial management tools while maintaining user engagement and satisfaction.

Feature Prioritization

Focus on features with high user impact and moderate effort, like personalized budgeting, goal setting, and transaction categorization, to deliver quick value while planning for more complex features like AI-driven advice.

High Impact, Low Effort (Quick Wins)

- Financial Goal Setting and Tracking: Simple to implement, directly addresses user needs for goal management.

- Notifications and Alerts: Essential for user engagement and security; relatively low development effort.

- Intuitive Onboarding Experience: Improves user experience, reducing cognitive load for new users.

- Personalized Dashboard: Provides quick access to financial information; customizable features enhance user satisfaction.

Design Process

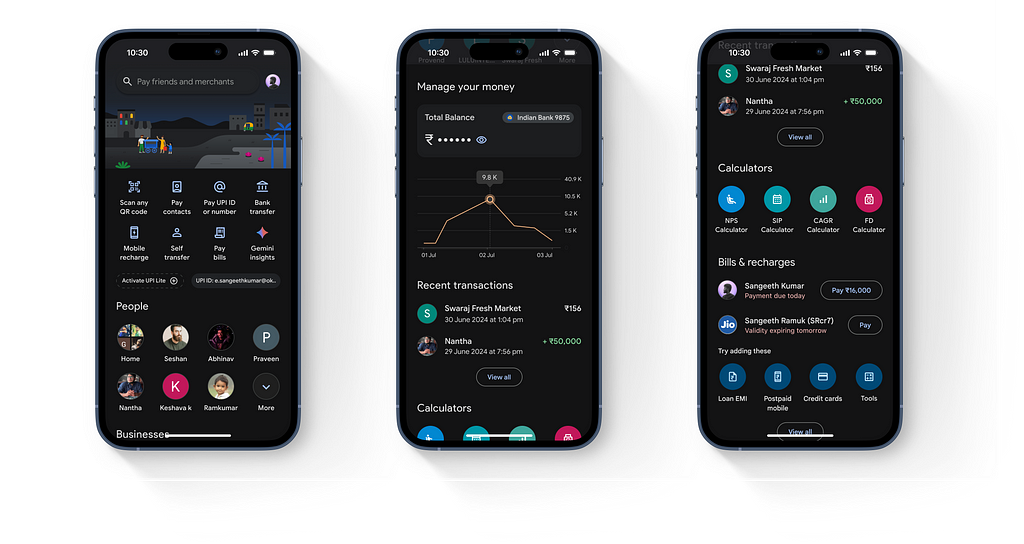

Based on comprehensive research and feature prioritization, I extensively analyzed the current Google Pay app, mapping its user flow to understand its structure, design language, and interaction patterns, ensuring a cohesive and seamless integration of the new design.

Although the iterative design process included the creation of wireframes and low-fidelity prototypes, for the sake of brevity in this case study, I am directly presenting the final high-fidelity designs.

Home Screen

The redesigned home screen offers quick access to essential features like scanning QR codes, sending money, paying bills, and viewing recent transactions. The integration of the new Gemini Insights feature is prominently displayed, making it easy for users to navigate their financial tools.

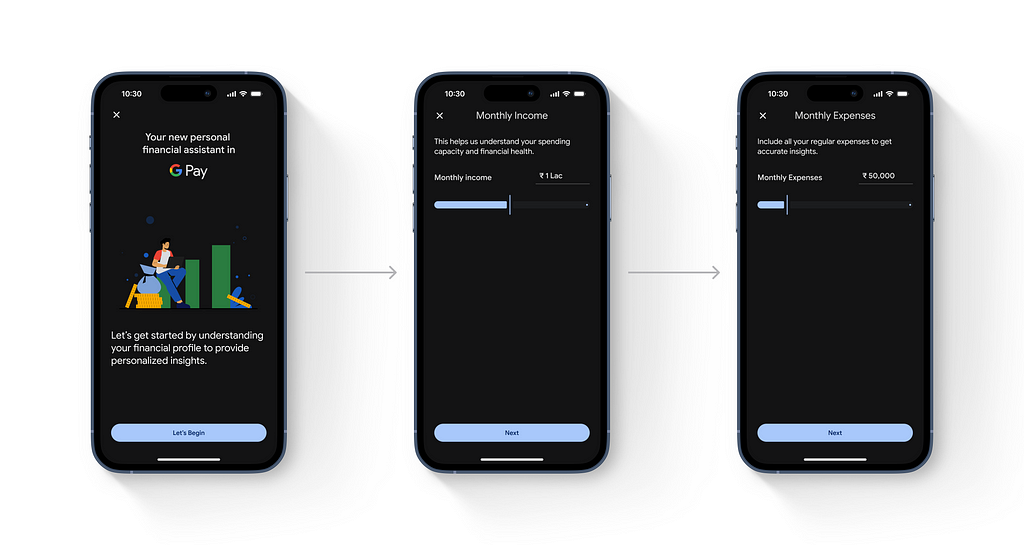

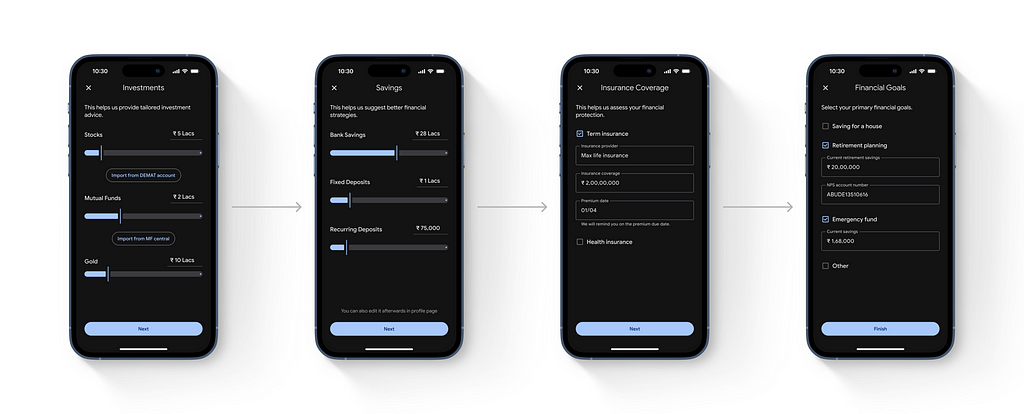

New Gemini Insights Onboarding Process

The onboarding begins with a Welcome Screen, highlighting the goal of personalized financial insights. Users enter their Monthly Income for budgeting advice, followed by Monthly Expenses for accurate insights. The Savings screen collects bank and deposit details, while Insurance Coverage captures term and health insurance. Finally, users set Financial Goals like saving for a house or retirement. This process gathers essential financial information simply and effectively, ensuring accurate data without overwhelming users.

Gemini AI Introduction and Insights

The introductory screen welcomes users to the enhanced Google Pay experience with Gemini AI. It sets the stage for the onboarding process by highlighting the goal of providing personalized financial insights.

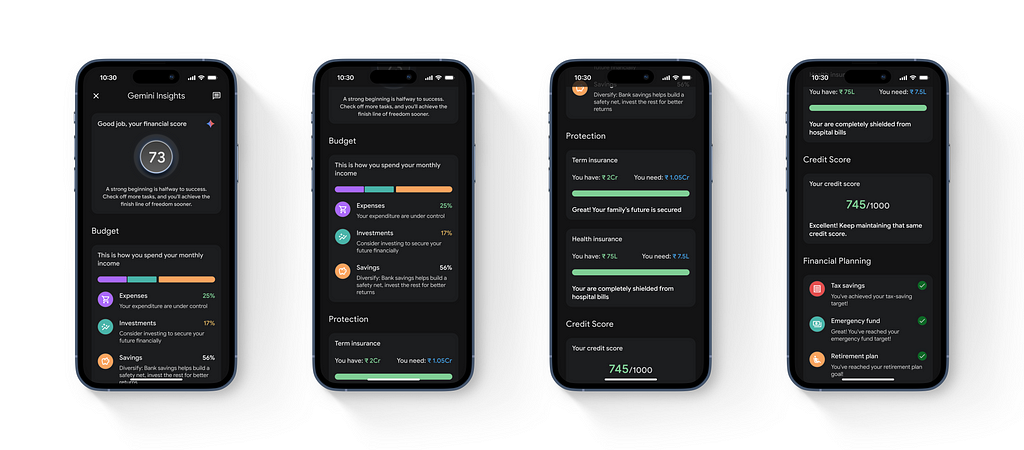

Gemini Insights

The Gemini Insights screen provides users with a comprehensive overview of their financial health, including a financial score, budget breakdown, protection (insurance coverage), credit score, and financial planning status. Each section includes actionable insights and recommendations.

Why?: Our research indicated that users wanted a clear and concise summary of their financial status. The insights screen is designed to provide valuable information at a glance, helping users make informed decisions.

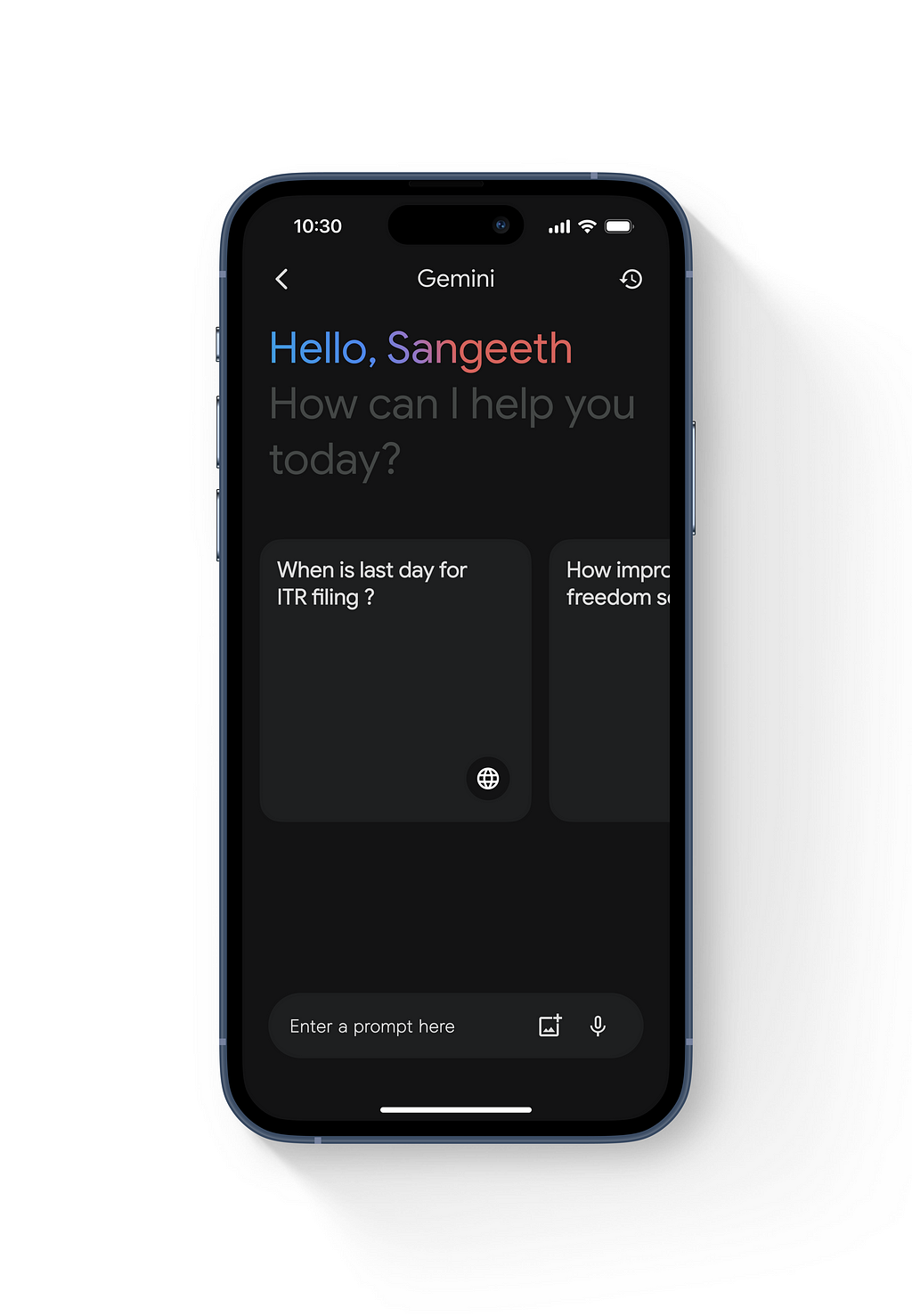

Gemini Chat

This interactive screen allows users to ask Gemini AI financial questions in a user-friendly interface, with a prompt area and examples of common queries, providing instant responses and personalized advice. We implemented this feature to offer real-time, personalized support, enhancing user engagement and satisfaction.

Tracking Financial Health

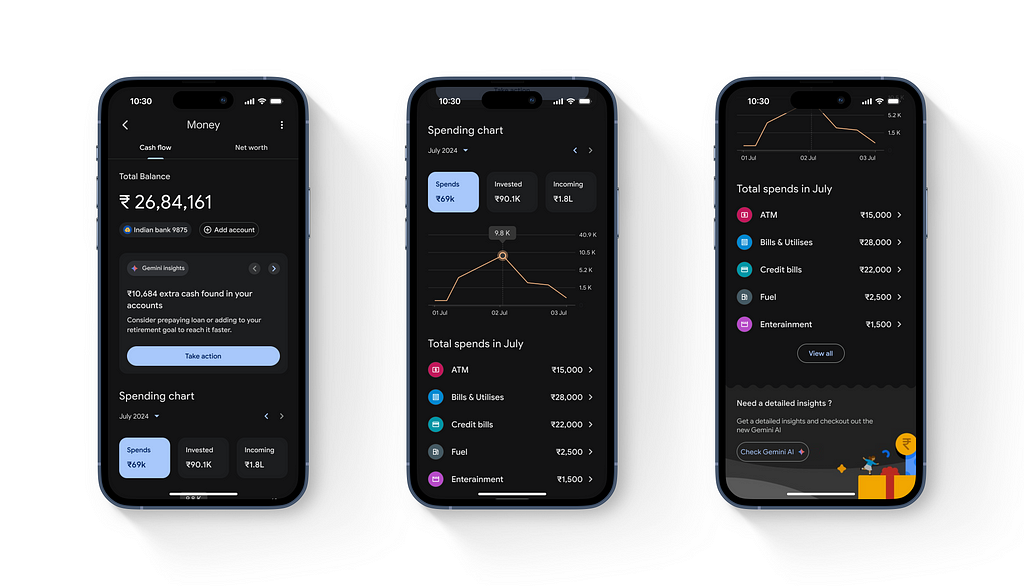

Cash Flow

The Cash Flow screen provides a detailed view of the user’s income, expenses, and spending patterns, including a spending chart and categorized expenses.

Net Worth

This screen shows the user’s net worth, including assets (bank balance, stocks, mutual funds, etc.) and liabilities (loans, credit).

The Why?: Understanding cash flow and net worth is crucial for financial health. Our research showed that users needed clear visualizations and easy access to this data to manage their finances effectively.

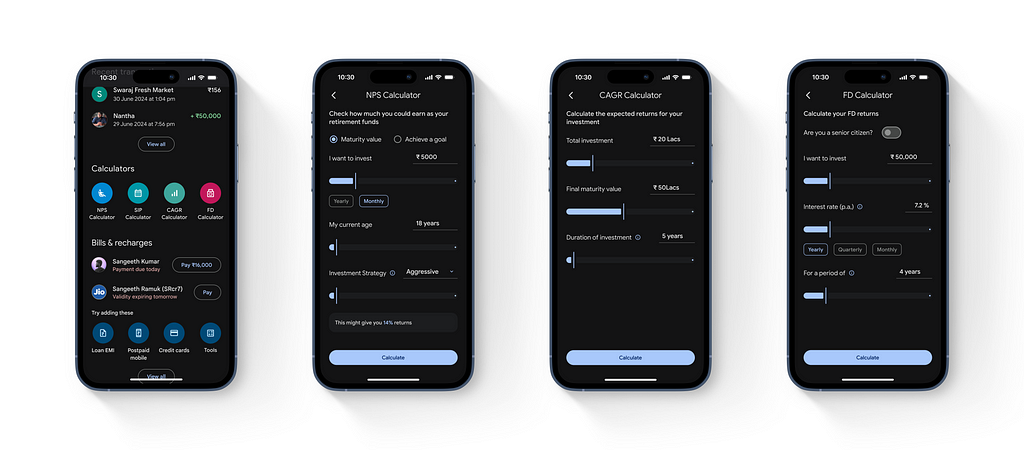

Financial Calculators

Users needed tools to plan and track investments easily. These calculators provide clear, actionable insights for informed financial decisions.

- NPS Calculator: Estimates retirement savings based on investment amount, age, and strategy.

- SIP Calculator: Calculates the future value of SIP investments using monthly amounts, periods, and growth rates.

- CAGR Calculator: Computes expected returns on investments over a specified period.

- FD Calculator: Calculates returns on fixed deposits based on investment amount, interest rate, period, and compounding frequency.

How Gemini Enhances User Experience

- Personalization: Gemini offers tailored insights and advice, making the app more relevant to individual users.

- Cognitive Load Reduction: By providing simplified financial information and recommendations, Gemini reduces the cognitive effort required to manage finances.

- User Engagement: Features like goal tracking and alerts keep users engaged and encourage regular app usage.

- Education: Gemini can educate users about financial management, enhancing their financial literacy over time.

Example Scenario

A user opens Google Pay, and Gemini analyzes recent transactions. It suggests that the user could save on dining out by cooking more at home, based on past spending patterns. Gemini also alerts the user about an upcoming bill and suggests reallocating part of their budget to cover it, keeping their financial goals on track.

Conclusion

Integrating Gemini into Google Pay can transform the app into a powerful financial management tool, offering users personalized insights, reducing cognitive load, and promoting better financial habits. This integration enhances user satisfaction and engagement, making it a valuable addition to the platform.

And that’s a wrap! Piqued your interest? Just holler!

Twitter | LinkedIn | Let’s Chat

Do follow me and send me suggestions. I’m happy to connect

Happy designing !!!

Case Study: Enhancing Financial Management with Google Pay and Gemini was originally published in UX Planet on Medium, where people are continuing the conversation by highlighting and responding to this story.