Customer Acquisition Cost (CAC) and Customer Lifetime Value (CLTV) are two key metrics that, when analyzed together, provide deep insights into the financial health and sustainability of a business.

Customer Acquisition Cost (CAC)

CACis the total cost a company incurs to acquire a new customer. It’s a crucial metric for understanding the efficiency and profitability of marketing and sales efforts.

CAC helps businesses determine how much they need to spend to attract new customers and whether their marketing strategies are sustainable.

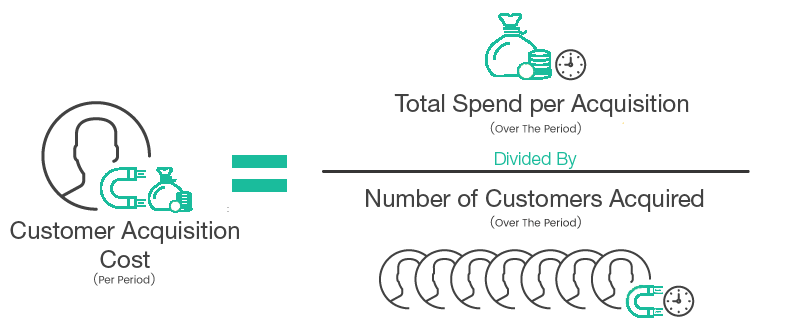

How to measure CAC?

CAC = ( Total Cost of Sales and Marketing ) / ( Number of New Customers Acquired ) = ( $ Amount )

4-steps process to calculate CAC

1.Determine the time period

Decide on the time frame for which you want to calculate CAC (e.g., monthly, quarterly, annually).

2. Calculate total sales and marketing costs

Include all marketing and sales expenses such as:

- Advertising spend (online, offline)

- Salaries of sales and marketing teams

- Software tools and services used for marketing and sales

- Agency fees

- Content creation costs (blogs, videos, etc.)

- Overhead costs related to marketing and sales

3. Identify the number of new customers acquired

Count the number of new customers acquired during the same period.

4. Calculate CAC using the formula provided above

Divide the total sales and marketing costs by the number of new customers acquired.

Tips and tricks to optimize CAC

Segment your audience: Focus your marketing efforts on the most profitable customer segments. Tailoring campaigns to specific segments can reduce wasteful spending and improve conversion rates.

Improve lead quality: Generate higher-quality leads by refining your targeting and messaging. Better leads convert at higher rates, reducing the overall cost of acquisition.

Enhance sales and marketing alignment: Ensure that sales and marketing teams are aligned in their goals, messaging, and strategies. Misalignment can lead to inefficiencies and higher CAC.

Invest in customer retention: While CAC focuses on acquisition, reducing churn and increasing customer lifetime value (LTV) can make your acquisition costs more justifiable. Focus on customer success and loyalty programs.

Customer Lifetime Value (CLTV)

CLTV estimates the total revenue a business can expect from a single customer over the duration of their relationship with the company. It’s a critical measure for understanding the long-term value of acquiring and retaining customers, and it helps in making informed decisions about marketing spend, customer acquisition strategies, and customer service investments.

How to Measure CLTV?

The basic formula to calculate CLTV is:

CLTV= (Average Purchase Value) × (Purchase Frequency) × (Customer Lifespan)

Tips and Tricks to Optimize CLTV

Improve Customer Retention: The longer customers stay with your business, the higher their lifetime value. Focus on customer retention strategies such as loyalty programs, personalized marketing, and excellent customer service.

Increase Average Order Value (AOV): Encourage customers to spend more per transaction through upselling, cross-selling, and bundling products.

Segment Your Customers: Different customer segments may have varying lifetime values. Tailor your marketing strategies to maximize CLTV for each segment.

Reduce Churn Rate: Identify the reasons why customers leave and address those issues. Lowering the churn rate directly increases the customer lifespan, thereby increasing CLTV.

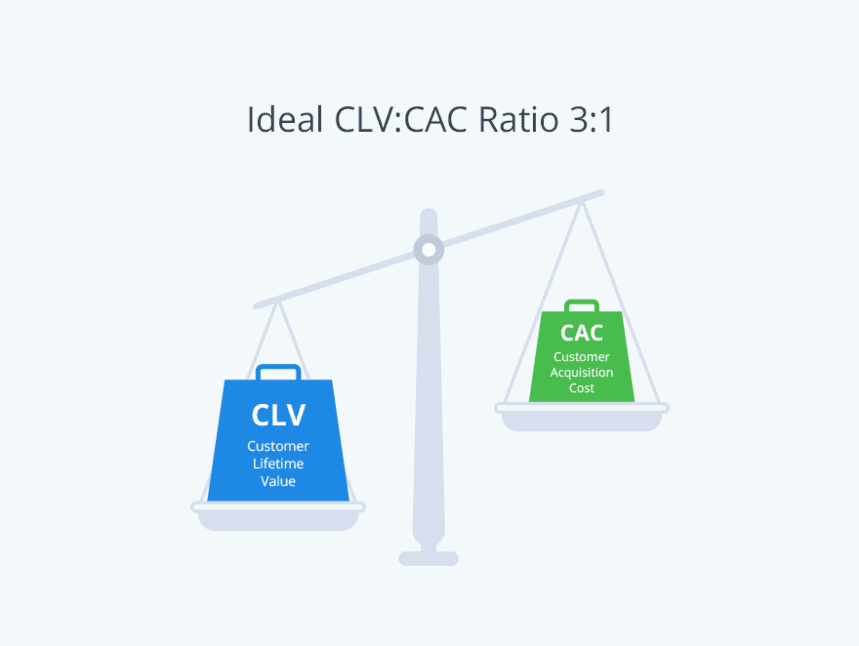

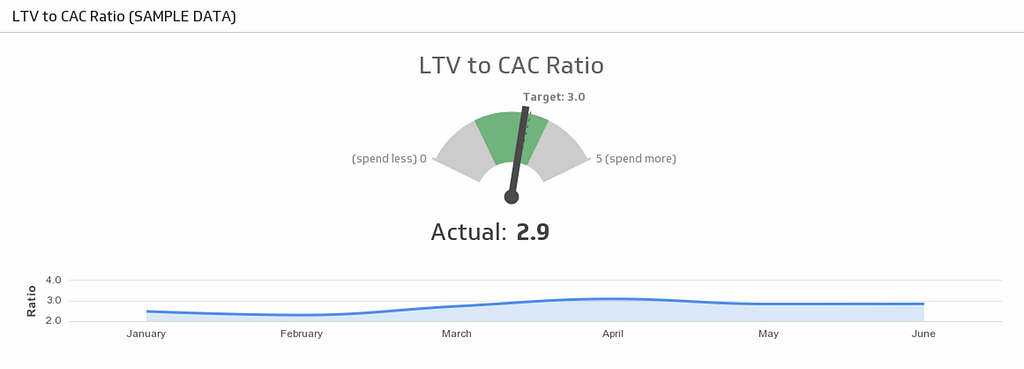

CLTV to CAC Ratio

Ideally, CLTV to CAC ratio should be 3:1 or higher. This means that for every dollar spent on acquiring a customer, the business should generate three dollars in revenue from that customer over their lifetime.

A ratio lower than 3:1 might indicate that the business is spending too much on acquisition relative to the value it is getting from each customer, which could hurt profitability.

A ratio significantly higher than 3:1 could suggest that the business is not investing enough in customer acquisition, potentially missing out on growth opportunities.

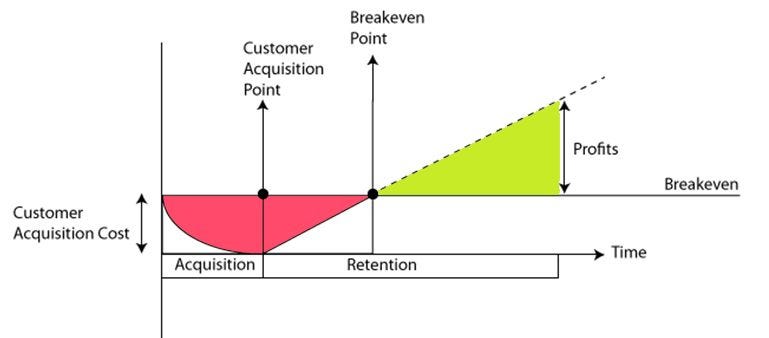

Breakeven point:

The breakeven point is the time it takes for the revenue generated by a customer to cover the cost of acquiring them (CAC).

A shorter breakeven point means that the business recovers its acquisition costs more quickly, leading to faster profitability. A long breakeven period might require the business to have significant cash reserves to sustain operations until profitability is achieved.

Want To Learn UX?

Try Interaction Design Foundation. It offers online design courses that cover the entire spectrum of UX design, from foundational to advanced level.

This post contains affiliate link(s)

Customer Acquisition Cost (CAC) and Customer Lifetime Value (CLTV): Essentials was originally published in UX Planet on Medium, where people are continuing the conversation by highlighting and responding to this story.