By Mary Moore, copywriter at Shakuro

Are you an aspiring entrepreneur or product owner struggling to find that perfect startup idea in the ever-evolving world of finance?

You may find yourself wrestling with several critical questions: What gaps exist in the market? How can I harness technology to improve financial processes? What features will genuinely resonate with users? The uncertainty can lead to a cycle of brainstorming, evaluation, and sometimes frustration.

In this article, we’ll explore some of the most promising fintech app ideas that can give your venture the competitive edge it needs. Whether you’re looking to streamline payment processes, enhance personal finance management, or innovate lending services, these concepts could be the keys to unlocking your startup’s potential.

Contents:

1️⃣ The rise of fintech apps

— The evolution of fintech apps

— Fintech impact on small businesses

— Fintech app trends

2️⃣ Top fintech app ideas for startups

— Personal finance management app

— Cryptocurrency trading platform

— Expense management app

— Invoice financing app

— Savings and investment app

— Business credit scoring app

— Insurance app

3️⃣ Real-life cases of fintech apps from Shakuro

— ZAD

— Solio

— Symbolik

— Aurox

4️⃣How to choose the right fintech app for your startup

The rise of fintech apps

To come up with a good idea, first, we need to dwell on the evolution of the fintech industry. How it emerged and what changes it underwent.

The evolution of fintech apps

Over the past decade, we have witnessed a remarkable transformation driven by technological advancements and shifts in consumer behavior.

Initially, a fintech app emerged as a simple online banking and payment processing tool. As technology advanced, these applications expanded to include comprehensive services such as invoicing, accounting, and cash flow management. This evolution has made financial services more accessible to small business owners without the resources to engage with traditional banking institutions.

1980s-1990s: Origins

The roots of fintech can be traced back to the 1980s with the introduction of electronic trading platforms and the use of algorithms in trading. The launch of the first online banking services in the 1990s marked a pivotal moment in financial services.

2000s: Emergence of online financial services

In the early 2000s, the rise of the Internet led to the appearance of various online financial services. Companies like PayPal emerged, revolutionizing online payments and paving the way for peer-to-peer payments.

2010s: The rise of startups

The 2010s saw a surge in fintech app development, driven by the need for more accessible and efficient financial services. Mobile banking, robo-advisors, and crowdfunding platforms began to gain popularity. Venture capital investments in fintech exploded, allowing numerous startups to flourish.

2020s: Mainstream adoption and regulation

As fintech matured, established financial institutions began to collaborate with fintech firms, leading to increased innovation. Regulatory challenges emerged, prompting governments to create frameworks for fintech operations. The COVID-19 pandemic accelerated the adoption of digital finance solutions worldwide.

Fintech impact on small businesses

One of the most significant impacts is the democratization of financial services. A fintech app typically offers lower fees, faster transactions, and more user-friendly experiences compared to conventional banks. Small businesses can manage their finances more effectively and affordably, fostering growth and innovation.

Additionally, the rise of alternative lending platforms has been a game changer. Companies can now access funding through peer-to-peer lending or crowdfunding platforms that bypass traditional credit assessments. This has allowed many entrepreneurs to secure capital that may have been previously inaccessible, driving entrepreneurship and enhancing market competition.

Moreover, fintech applications have improved financial literacy and management capabilities among small business owners. Many apps provide valuable insights and analytics, allowing entrepreneurs to make data-driven decisions. With enhanced visibility into their financial health, small businesses can better forecast cash flow, manage expenses, and plan for growth.

Fintech app trends

The fintech industry is rapidly evolving, with several key trends shaping the future of financial technology apps. That’s why, if you want to be at the top of the mountain, you need to stay with the flow. Here are some of the latest trends in fintech app development that you can leverage in your projects:

- Artificial Intelligence and Machine Learning:

Many industries increasingly utilize AI and machine learning, and the fintech industry is no exception. With smart algorithms, you can offer personalized financial advice, assess credit risk, and auto-detect fraudulent activities. These technologies enhance user experience and improve security.

2. Blockchain and Cryptocurrency Integration:

The adoption of blockchain technology and cryptocurrency transactions is on the rise. Think about integrating crypto wallets and offering services related to blockchain to cater to the growing interest in digital currencies.

3. Open Banking:

Open banking enables third-party developers to build applications and services around financial institutions. This trend allows consumers to share their financial data securely with multiple apps, promoting innovation and enhanced financial services.

4. RegTech Solutions:

As regulations become more complex, a fintech app incorporates regulatory technology (RegTech) to streamline compliance processes. This helps businesses manage compliance more efficiently and avoid potential penalties.

5. Embedded Finance:

Non-financial companies are starting to offer financial services directly within their platforms. For example, e-commerce platforms might provide payment processing, lending, or insurance options, creating a seamless user experience.

6. Digital Wallets and Contactless Payments:

With the rise of digital payment methods, products are emphasizing the development of digital wallets and contactless payment solutions. These fintech app trends have gained traction due to the COVID-19 pandemic, which accelerated the shift to cashless transactions.

7. Peer-to-Peer (P2P) Lending:

P2P lending platforms continue to gain popularity by connecting borrowers directly with lenders, bypassing traditional financial institutions. The trend democratizes access to credit and often offers better interest rates for both parties.

8. Financial Health and Wellness:

Financial wellness is as important as health wellness. So there’s a growing focus on apps that offer budgeting tools, savings plans, and investment advice. These fintech app ideas aim to help users improve people’s overall financial health and education.

9. Sustainable Finance:

Green fintech is emerging, focusing on sustainable and socially responsible investment options. More consumers are looking to invest in companies and projects that align with their values, pushing fintech apps to offer environmentally conscious solutions.

10. Cybersecurity Enhancements:

As applications handle sensitive financial information, there is an increasing emphasis on developing advanced cybersecurity measures. Companies are investing in technologies and protocols that protect users from data breaches and fraud.

Top fintech app ideas for startups

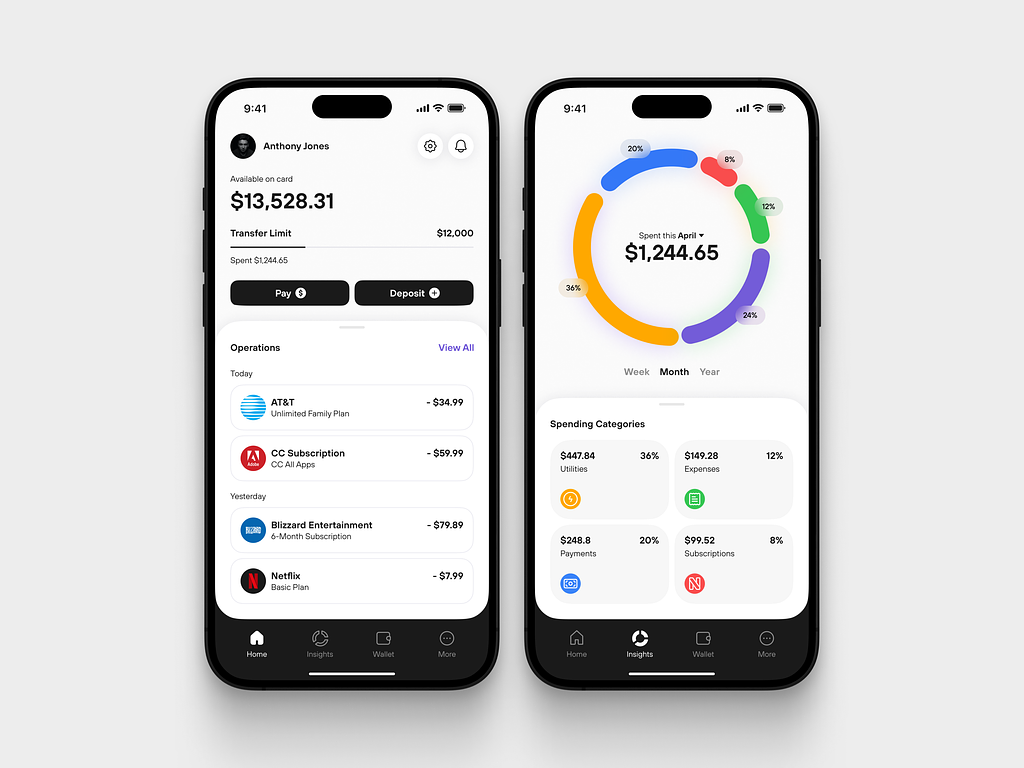

Personal finance management app

It can empower users to take control of their finances by providing them with tools to budget, track expenses, set financial goals, and improve their overall financial literacy.

This idea is a valuable startup opportunity to address consumers’ growing need for financial literacy and management tools. By leveraging technology to provide personalized insights, you can help individuals achieve their goals while fostering healthier financial habits.

What are the key features?

- Budgeting Tool:

Allow users to set personalized budgets across different categories (e.g., groceries, entertainment, utilities) and track their spending in real-time. Also, the tool alerts people when they are nearing their budget limits.

2. Expense Tracking:

Automate transaction tracking by linking users’ bank accounts and credit cards. Provide insights into spending patterns with visual graphs and reports to help people understand their financial habits.

3. Savings Goals:

Users can set specific savings goals (e.g., vacation, emergency fund, down payment for a house) and track their progress. The fintech app can suggest ways to cut unnecessary spending to help meet those goals faster.

4. Personalized Financial Insights:

Analyze users’ financial data and offer tailored insights, such as recommendations for better spending habits or savings suggestions based on their unique situation. To manage large data amounts, you can leverage Artificial Intelligence.

5. Bill Reminders and Payments:

Implement a reminder system for upcoming bills and offer an option to pay bills directly through the app, ensuring users never miss a payment and avoid late fees.

6. Investment Tracking:

Include features to track investments, providing users with an overview of their portfolio performance and suggesting rebalancing strategies when necessary.

7. Financial Education Resources:

Offer educational content like articles, videos, and webinars to help users improve their financial literacy. Cover topics like credit scores, investment basics, and savings strategies.

8. Gamification Elements:

Incorporate gamification techniques to encourage users to engage actively with the app. Offer rewards for reaching milestones, completing challenges, or consistently staying within budget.

9. Community Support:

Create a community forum or support group within the app where users can share tips, ask questions, and motivate each other on their financial journeys.

10. Data Security and Privacy:

During fintech app development, implement strong security measures to protect users’ financial information. Employ encryption and offer transparent privacy policies to build trust.

Monetization strategies:

- Freemium Model: Offer a basic version of the app for free, with the option to upgrade to a premium subscription that includes advanced features like comprehensive financial analysis, personalized consultation, ad-free usage, etc.

- Affiliate Partnerships: Collaborate with financial institutions and services (e.g., credit card companies, and loan providers) to earn commission through referrals when users take advantage of their offerings.

- In-app Purchases: Provide additional features or content (e.g., financial workshops, and one-on-one coaching sessions) as in-app purchases.

An example of a personal financial app is YNAB (You Need A Budget). It helps users manage their finances with zero-based budgeting. The app emphasizes a proactive approach to budgeting, allowing individuals to allocate their income toward specific spending categories.

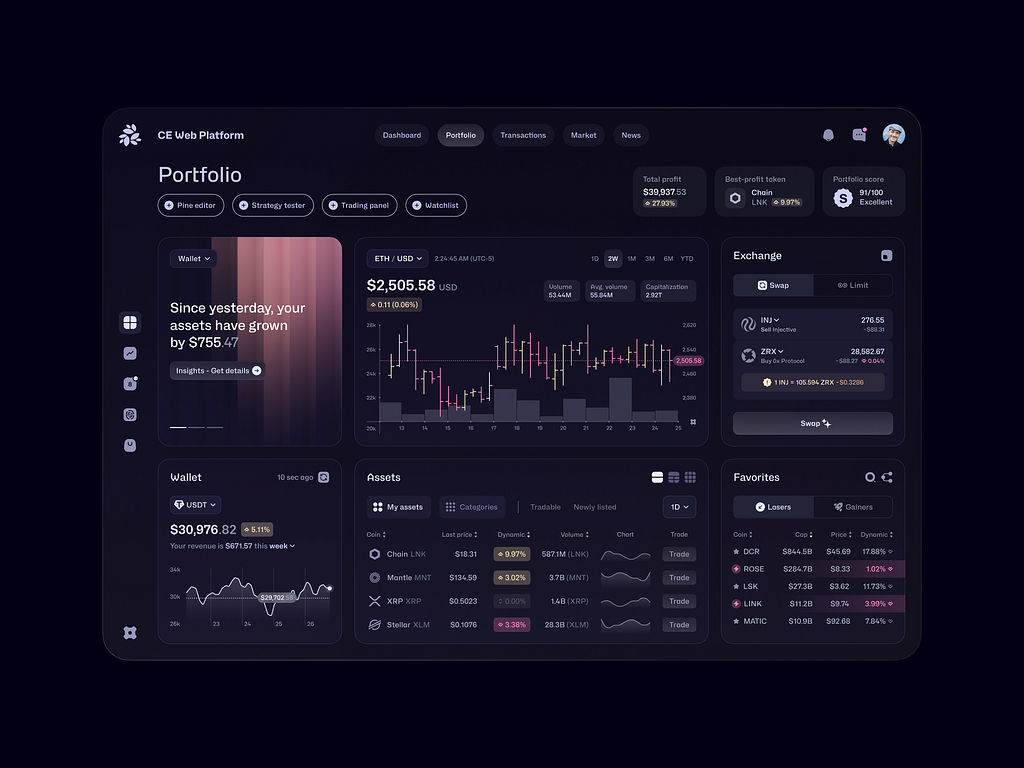

Cryptocurrency trading platform

These fintech app ideas facilitate the buying, selling, and exchanging of various cryptocurrencies, providing users with advanced trading tools to navigate the digital asset market.

And you can capitalize on the growing interest in digital assets. By focusing on user experience, security, and comprehensive educational resources, your platform can attract a diverse range of users, from novices to seasoned investors, and help them successfully navigate the evolving world of cryptocurrencies.

What are the key features?

- Advanced Trading Tools:

Offer advanced charting tools, technical analysis indicators, and market depth data that cater to seasoned traders looking for comprehensive market insights.

However, if your target audience is mostly beginner traders, implement simplified tools and educational resources into your fintech app.

2. Multiple Cryptocurrency Support:

Support a wide range of cryptocurrencies, including major ones like Bitcoin, Ethereum, and newer altcoins. Regularly update the platform with new listings based on market demand.

3. Wallet Integration:

Integrate secure in-app wallets for users to store their cryptocurrencies safely within the platform, minimizing the need to rely on external wallets.

4. Staking and Yield Farming Options:

Introduce features that allow users to stake cryptocurrencies or participate in yield farming, enabling them to earn rewards on their holdings.

5. Security Features:

Implement robust security measures, such as two-factor authentication, cold storage for funds, and regular security audits to ensure user data and assets are protected.

6. Community Engagement:

Create community forums and chat features where users can share insights, discuss market trends, and seek advice from more experienced traders.

7. Customer Support:

Offer responsive customer support through live chat, email, and a comprehensive FAQ section to address user queries or issues promptly.

Monetization strategies:

- Transaction Fees: Charge a small fee for each transaction executed on the platform, which can vary based on the trading volume or user tier (e.g., higher tiers have lower fees).

- Subscription Model: Introduce tiered subscription plans that offer additional features, such as lower fees, access to premium trading tools, or exclusive market reports.

- Staking and Yield Fees: Collect a small fee on returns earned through staking or yield farming features offered on the platform.

- Affiliate Marketing: Partner with crypto-related services and earn commissions on referrals, such as exchanges, wallets, or educational platforms.

An example of a cryptocurrency trading app is Coinbase. It is one of the largest cryptocurrency exchanges in the world. The app allows users to buy, sell, and manage various cryptocurrencies such as Bitcoin, Ethereum, and many others. At the same time, it is designed for both beginners and experienced traders.

Expense management app

With these fintech app ideas, you help users track, categorize, and optimize their spending in real-time. They get insights into their financial habits and make informed decisions about their finances.

This way, you address the growing need for financial literacy and expense tracking. In the era of spontaneous digital purchases, you can empower users to take control of their finances and make smarter spending decisions.

What are the key features?

- Automatic Transaction Import:

Allow people to connect to their bank accounts and credit cards to automatically import and categorize transactions, reducing the need for manual entry. Alternatively, you can incorporate receipt scanning, so users can upload the receipts and extract the data.

2. Customizable Categories:

Custom spending categories align better with personal financial goals and habits. The feature also adds an extra chunk of personalization to your app.

3. Budgeting Tools:

Offer budgeting features to set monthly spending limits for different categories and receive notifications when users approach their limits.

4. Expense Analytics:

Provide detailed reports and visualizations, such as pie charts and graphs, to help users understand their spending patterns and identify areas for improvement.

5. Multi-User Support:

Allow families or teams to manage shared expenses in your fintech app, providing individual and collective insights into spending for better financial collaboration.

5. Goal Setting and Tracking:

Facilitate goal setting for savings or debt reduction and track progress over time, motivating users to adhere to their financial plans.

6. Alerts and Reminders:

Send alerts for upcoming bills, subscription renewals, and unusual spending activity to help users stay on top of their finances.

7. Data Security:

Implement strong security measures, such as encryption and two-factor authentication, to protect users’ sensitive financial information.

Monetization strategies

- Freemium Model: Offer a basic version for free with essential features and charge for premium features like advanced analytics, customization options, and priority support.

- Subscription: Introduce monthly or yearly subscription plans that unlock additional tools, such as personalized financial coaching or in-depth spending analysis.

- Affiliate Partnerships: Collaborate with financial institutions or budgeting-related services and earn commissions for referrals or recommendations made through the app.

- Sponsored Content: Feature financial products or services relevant to the target audience within the app, providing informative content while generating revenue through sponsorships.

- Data Insights Sales: With user consent, aggregate anonymized data to provide insights to businesses or researchers interested in consumer behaviors while ensuring user privacy.

An example of an expense management app is Expensify. It combines personal and business expense tracking capabilities, offering a manual receipt scan and automatic expense categorization.

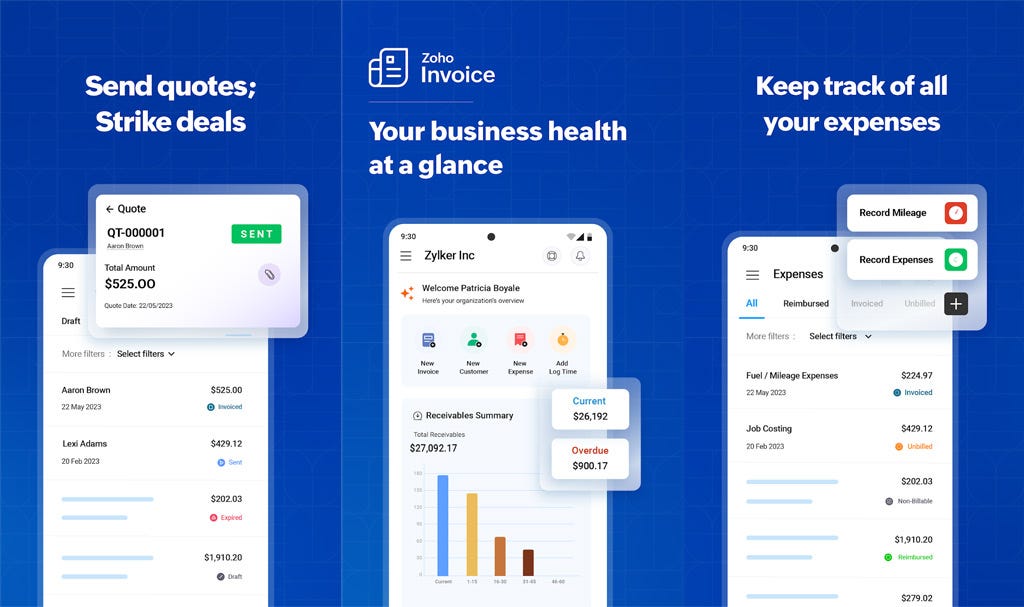

Invoice financing app

This option helps businesses manage cash flow by allowing them to sell their outstanding invoices to third-party funders in exchange for immediate cash. These fintech app ideas bridge the gap between invoicing and payment, providing companies with quicker access to working capital.

In this case, you deal with businesses’ cash flow challenges while enabling them to grow without the constraints of traditional lending. By offering flexible financing solutions and ensuring transparency, your application can empower small and medium businesses to maintain financial health and take advantage of growth opportunities.

What are the key features?

- User-Friendly Dashboards:

The product will be data-heavy since it will contain lots of invoices, view funding options, and tracking. Create an intuitive interface for businesses to manage their financing requests with ease.

2. Invoice Submission:

Allow users to upload or create invoices directly within the fintech app, simplifying the submission process.

3. Instant Funding Options:

Provide real-time assessments for invoice financing, giving businesses immediate insights into how much funding they can access based on their outstanding invoices.

4. Flexible Financing Terms:

Offer various financing options, such as different advance rates and repayment structures, tailored to the unique needs of each business.

5. Credit Risk Assessment:

Integrate a system for assessing the creditworthiness of a business’s customers (the debtors), which can help determine the financing terms and rates.

6. Automated Notifications:

Send alerts for key events, such as when invoices are funded, due dates, or reminders when customer payments are received.

7. Funds Tracking:

Enable users to track the status of their invoices, funding, and repayment schedules, offering transparency throughout the financing process.

8. Integration with Accounting Software:

Allow seamless integration with popular accounting software tools to streamline invoice management and eliminate manual data entry.

9. Reporting and Analytics:

Provide businesses with insights and analytics on their financing activities, allowing them to evaluate cash flow trends and manage liquidity more effectively.

10. Customer Support:

Offer robust customer support through chat, email, or phone to assist users with their financing needs and inquiries.

Monetization Strategies:

- Service Fees: Charge a fee based on a percentage of the invoice amount financed, generating revenue for each transaction processed through the app.

- Subscription Model: Introduce subscription plans that offer additional features or lower fees, appealing to businesses that engage in frequent financing.

- Premium Analytics Tools: Offer advanced data analytics tools and reports to businesses at a premium, helping them make more informed financial decisions.

- Partnering with Funders: Form partnerships with third-party funders and charge them for leads or successful financing agreements made through the app.

- Value-Added Services: Provide additional services such as credit insurance, risk assessment tools, or financial consulting for an extra charge.

An example of an invoice financing app is Zoho Invoice. It offers a free option, so it’s a go-to if you have a tight budget. Also, you can leverage ready-made invoice templates, import contacts, categorize expenses, etc.

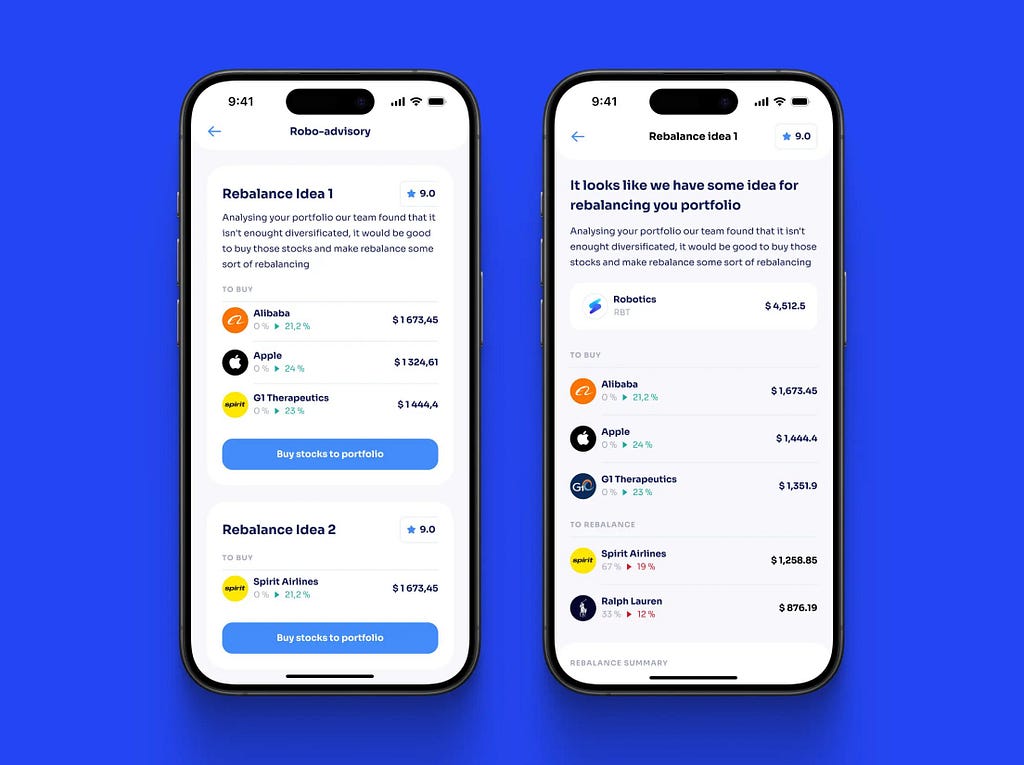

Savings and investment app

Apart from a simple saving application, you can opt for an investment app. The fintech app allows users to manage their savings and investment goals in a user-friendly and engaging way. You can help individuals learn about investing, automate their savings, and provide personalized investment advice, ultimately encouraging better financial habits.

What are the key features?

- Goal-Based Savings:

Add options to set specific savings goals (e.g., vacation, emergency fund, home purchase) and track the user’s progress toward achieving those goals.

2. Automated Savings Plans:

Provide features that allow users to set up automated transfers from their checking accounts to their savings accounts based on customizable rules (e.g., rounding up purchases, and setting fixed monthly contributions).

3. Diverse Investment Options:

Offer various investment opportunities, such as stocks, ETFs, mutual funds, or robo-advisory services, allowing users to choose investment products based on their risk tolerance and investment goals.

4. User Education:

Incorporate educational resources, such as articles, videos, and tutorials, to help users understand investment fundamentals, market trends, and strategies for successful investing.

5. Portfolio Diversification:

Provide personalized investment recommendations that encourage diversification across different asset classes to minimize risk and enhance returns.

6. Impact Investing Options:

Introduce sustainable and socially responsible investment choices, appealing to users interested in making a positive social or environmental impact while investing.

7. Real-Time Performance Tracking:

Allow users to monitor the performance of their savings and investments in real-time with easy-to-read graphs and analytics.

8. Risk Assessment Tools:

Integrate features that assess users’ risk tolerance and financial situations to create personalized investment strategies tailored to their needs.

9. Community Features:

Foster a community or forum where users can share experiences, tips, and insights about saving and investing, which encourages engagement and learning.

10. Security and Privacy:

Ensure robust security measures to protect businesses’ financial information, including encryption and two-factor authentication.

Monetization strategies:

- Transaction Fees: Charge a small fee for each transaction made within the fintech app, such as buying or selling investments.

- Subscription Model: Offer premium features or advanced investment tools through a monthly or annual subscription plan.

- Advisory Fees: If providing managed investment services, charge a percentage-based fee on assets under management (AUM).

- Affiliate Partnerships: Form partnerships with banks or financial institutions to earn referral commissions for users who open accounts through the app.

- Educational Courses: Offer paid access to in-depth courses or webinars that cover advanced investment topics, financial planning, or wealth management strategies.

An example of an investment app is Robinhood. It combines stock trading with investment, offering commission-free trading of stocks and ETFs, in-app educational courses, and branded cash cards.

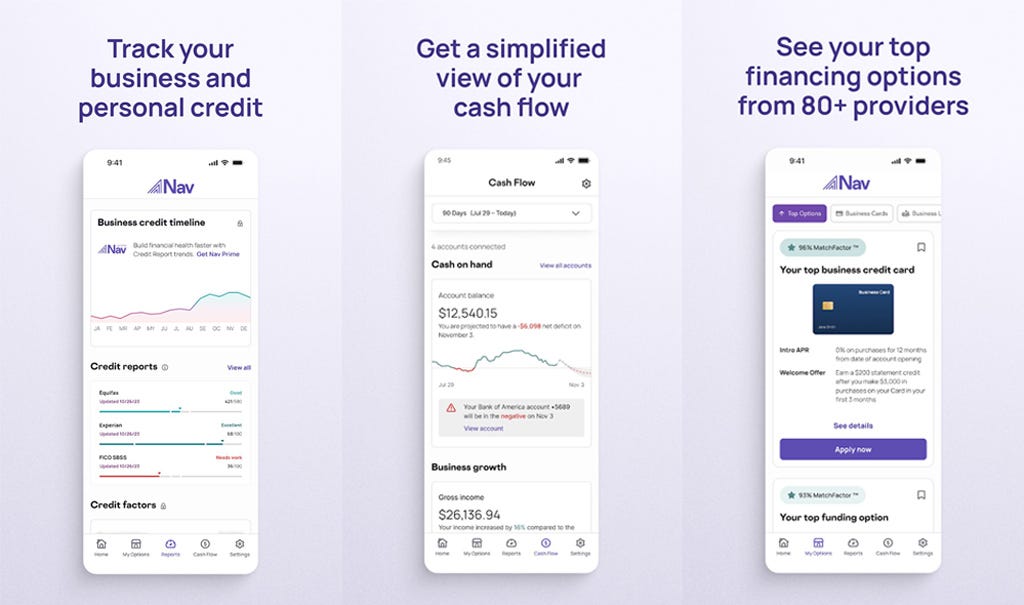

Business credit scoring app

The fintech app idea aims to provide small and medium-sized enterprises (SMEs) and startups with a comprehensive understanding of their creditworthiness. You offer real-time credit scores, insights, and actionable advice to help businesses maintain healthy credit profiles, secure financing, and make informed financial decisions.

What are the key features?

- Real-Time Credit Scoring:

Add instant access to business credit scores based on various factors such as payment history, credit utilization, financial health, and industry benchmarks.

2. Credit Monitoring:

Enable real-time monitoring of users’ credit profiles, alerting them to significant changes, potential fraud, or important updates that could affect their creditworthiness.

3. Detailed Credit Reports:

Offer comprehensive credit reports that break down the components of a business’s credit score, including payment history, public records, and credit inquiries, helping users understand the factors affecting their score.

4. Financial Health Insights:

Integrate tools to analyze business financial statements and cash flow, providing insights on how to improve credit health and financial performance.

5. Actionable Recommendations:

Deliver personalized suggestions for improving credit scores, such as timely payments, reducing debt, and managing credit utilization more effectively.

6. Educational Resources:

Include articles, videos, and tips on understanding business credit scores, the importance of maintaining a good credit profile, and how to prepare for loan applications.

7. Integration with Accounting Software:

Allow seamless integration with popular accounting software to automatically track and report business financials, making it easier for users to manage their credit health.

8. Peer Comparison:

Offer benchmarking tools that allow users to compare their credit scores and financial performance against industry peers, helping them identify areas for improvement.

9. Loan Application Tools:

Facilitate a streamlined loan application process by providing pre-qualification assessments to determine the best financing options based on users’ credit profiles.

10. Security and Privacy:

Implement strong security protocols to protect sensitive business information, including encryption, multi-factor authentication, and compliance with data protection regulations.

Monetization strategies

- Subscription Model: Charge users a monthly or annual fee for premium features, such as detailed credit reports, monitoring alerts, and personalized consulting services.

- Affiliate Partnerships: Collaborate with lenders and financial institutions to offer referral programs, earning commissions for each loan application generated through the app.

- Consulting Services: Provide premium consulting services for businesses seeking tailored advice on improving their credit scores or navigating the loan application process.

- Educational Courses: Offer paid resources, webinars, or courses focused on financial management, credit improvement strategies, and business growth.

- Data Analytics: Aggregate anonymized data for market research and sell insights to financial institutions looking to understand trends and behaviors among SMEs.

An example of a business credit scoring app is Nav. It helps you manage your company credit, enhance your overall financial health, and obtain the finance you require to flourish.

Insurance app

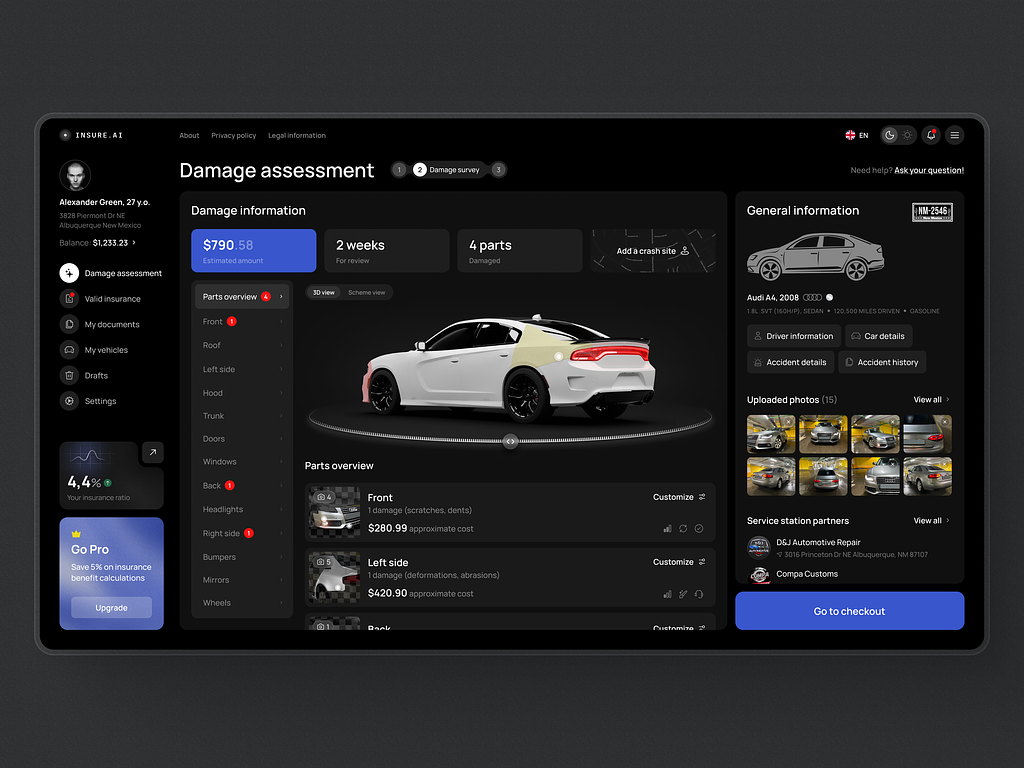

The fintech app idea revolutionizes the way individuals and businesses interact with their insurance policies. The app simplifies the buying process, enhances customer engagement, and streamlines claims management, all while using advanced technologies to provide personalized insurance solutions.

What are the key features?

- Instant Quotes:

Allow users to receive instant insurance quotes for various types of coverage (auto, home, health, business) by entering basic information, making it easier to compare options.

2. Policy Management:

Provide a user-friendly dashboard where customers can easily view, manage, and renew their insurance policies, track payment history, and access policy documents.

3. Claims Submission:

Streamline claims process where users can file claims directly through the app, upload necessary documents, and track the status of their claims in real-time.

4. Claims Assistance:

Leverage fintech app trends and incorporate an AI chatbot that can guide users through the claims process, answer common questions, and provide assistance with documentation.

5. Customizable Coverage:

Offer personalized policy recommendations based on user profiles, preferences, and circumstances, allowing customers to tailor coverage to their specific needs.

6. Risk Assessment Tools:

Include tools that analyze users’ risk factors and provide insights on how to reduce risks (e.g., home safety tips, safe driving advice), which could potentially lower insurance premiums.

7. Educational Resources:

Provide a library of articles, guides, and videos that educate users about different types of insurance, policy details, and best practices for choosing coverage.

8. Multi-Policy Discounts:

Encourage users to bundle their insurance policies (e.g., auto and home) through discounts or rewards, increasing customer loyalty and retention.

9. Referral Program:

Incentivize users to refer friends and family to the app by offering discounts or cash rewards for successful referrals, expanding your user base.

10. Integration with Financial Planning Tools:

Offer integration with budgeting and financial planning tools to help users understand how insurance costs fit into their overall financial strategy.

Monetization strategies:

- Commission-Based Model: Earn commissions on policy sales and renewals through partnerships with insurance providers, acting as an aggregator for multiple insurance products.

- Premium Membership: Introduce a subscription model that offers users access to premium features, such as personalized consulting, advanced risk assessments, or loyalty rewards.

- Educational Workshops: Conduct paid online workshops or webinars focusing on personal finance, risk management, and understanding insurance, appealing to users seeking in-depth knowledge.

- Sponsored Content: Collaborate with insurers for sponsored content or featured listings within the app, promoting their products to your user base.

- Data Analytics Services: Offer aggregated data insights to insurers and financial institutions, helping them understand market trends and customer preferences.

An example of an insurance app is Digit Insurance. All processes there are paperless, with auto-renewal, simplified policies and claims. There are insurances for transport, healthcare, and property.

Real-life cases of fintech apps from Shakuro

We’ve described seven fintech app ideas that are viral in the industry. However, there is one piece missing: you need a development team experienced in fintech to bring the projects to life.

At Shakuro, we collaborated with several fintech startups on mobile apps, UI/UX design, and branding. Leveraging industry expertise and a cutting-edge toolkit, our team helps businesses build competitive projects.

Here are four real-life industry cases we’re proud of:

ZAD

It is a Shariah-compliant mobile investment platform combining robo-advisor and trading functionality with a comprehensive approach making investments easy and accessible.

Before starting fintech app development, our team conducted an in-depth study of the leading stock trading apps in West Asia and familiarized ourselves with the tenets of Shariah law.

Since the ZAD target audience is everyday customers aged between 20 to 40, we aimed to provide a secure and user-friendly interface, conveyed in a professional and supportive tone, that would instill confidence in the users. We wanted them to feel a sense of security and assurance.

Solio

Solio is a Korean stock trading app that allows users to receive passive income without specific knowledge and experience. The development required a deep analysis of the market, legal and social expectations, and a fair money management system.

We pack robust functionality and complicated infrastructure into a user-friendly interface with familiar app mechanics. The design is approached from the perspective of problem-solving and not just artistic expression, so the team emphasized the balance and individual performance of the stocks the client owns. For beginners, Solio offers pre-made model portfolios and a robo-advisor as a guide.

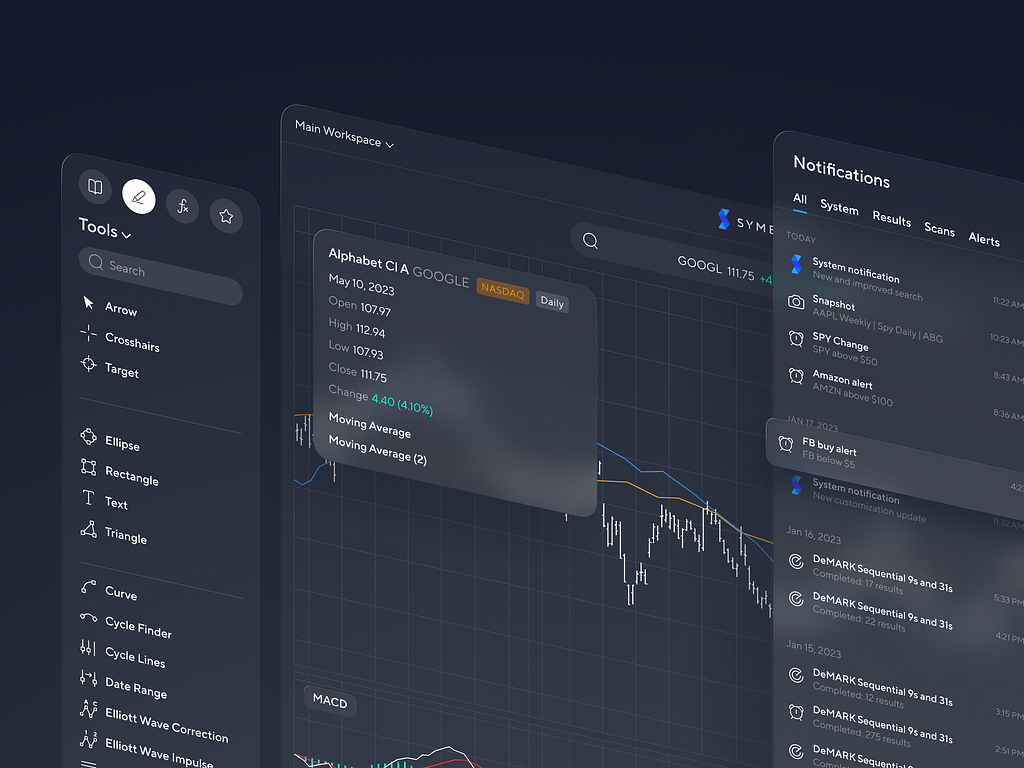

Symbolik

Symbolik is a product of the legendary Tom DeMark’s legacy. This is one of the most comprehensive projects we’ve worked on and consists of several tools.

It combines a charting tool, a trading analysis platform, and a social network for traders, investors, and money managers. Together with Symbolik, we redesigned the entire ecosystem with the website: built the Symbolik Social network from scratch, revamped the Symbolik Chart, and breathed new life into the brand’s identity.

Symbolik Social is a social network for traders, where they exchange experiences, know-how, tools, and so on. It is a whole financial community with a peer-generated knowledge base. We built the network from the ground up, taking into account the target audience’s needs and craving for exclusive financial insights.

Symbolik Chart is a professional-grade investment tool and analytics. Traders and investors leverage it to gain market insights, technical analysis, and exclusive add-ons. It offers custom condition builders, price alerts, real-time scans, and extensive data coverage — anything a pro trader might need.

Aurox

It is a leading cryptocurrency trading terminal, market cap website, and issuer of the $URUS token powering an advanced lending and trading system. Apart from comprehensive branding, we also worked on website UI/UX design and mobile app to strengthen the Aurox services.

We opted for ease of use and glanceability so users would have an easier time leveraging the terminal. Spiced up with 3D illustrations and animations, it catches the eye. Also, Aurox needed a motion design for promo reels, and we were happy to provide it.

How to choose the right fintech app for your startup

- Identify Your Target Audience:

Understand who your potential users are. Are you targeting individual consumers, small businesses, or large enterprises? Knowing your audience will help you tailor the app’s features and services to meet their needs.

2. Define Your Value Proposition:

Clearly showcase what makes your fintech app unique. What problem does it solve? How does it improve the user experience compared to existing solutions? A strong value proposition will help differentiate your app in a crowded marketplace.

3. Research Market Trends:

Stay updated on industry trends and emerging technologies in the fintech sector. Analyze competitors to learn what features are popular and what gaps exist in the market that your app could fill.

4. Focus on Compliance and Security:

Regulatory compliance is crucial in fintech. Ensure that your app adheres to legal requirements and industry standards. Prioritize data security to build trust with users, as they are concerned about their financial information.

5. Choose the Right Technology Stack:

Select a technology stack that supports your app’s requirements, scalability, and performance. Consider factors like fintech app development cost, speed of deployment, and ease of integration with third-party services.

6. UI/UX Design:

Invest in a user-friendly design that provides a seamless experience. A clean, intuitive interface will enhance user satisfaction and retention. Conduct user testing to gather feedback and refine the app’s design.

7. Integrate Essential Features:

Identify critical features for your app based on your market research and target audience. This may include budgeting tools, investment tracking, payment processing, or insurance management. However, avoid implementing all features at once and focus on core functionalities for the MVP (Minimum Viable Product).

8. Plan for Scalability:

Choose solutions that allow easy updates and scaling as your user base grows. A scalable app can handle increased traffic and functionality without compromising performance.

9. Validate with a Prototype:

Create a prototype or wireframe of your app to visualize its layout and features. Use it to gather feedback from potential users and stakeholders before investing in full-scale development.

10. Develop a Marketing Strategy:

Plan how you will promote your app once it’s launched. Utilize social media, content marketing, SEO, and partnerships to create awareness and attract users. A well-defined marketing strategy is essential for user acquisition.

11. Budget and Funding:

Assess your financial resources and seek funding if needed. Understanding your budget will guide your decisions on development, marketing, and operational costs throughout the startup phase.

12. Gather a Strong Team:

Build a diverse team with fintech, development, marketing, and compliance expertise. A strong team is essential for navigating the complexities of this industry and bringing your app to fruition.

Conclusion

Whether you’re exploring personal finance management, digital banking solutions, investment platforms, or payment processing innovations, the key lies in identifying pain points and delivering tailored solutions that enhance user experience.

The journey requires a creative vision, in-depth market research, and a clear understanding of user needs. By following these principles and continuously adapting to the ever-changing financial environment, startups can position themselves for success and contribute to the future of financial services. With the right approach, your fintech app idea could be the next big breakthrough in the industry, making finance more accessible, efficient, and user-friendly for everyone.

Originally published at https://shakuro.com.

From Concept to Success: 7 Fintech App Ideas for Startup Growth was originally published in UX Planet on Medium, where people are continuing the conversation by highlighting and responding to this story.