If you’re in product, tech, or design, chances are that you’re quite familiar with the term ‘Gamification’.

In my years of experience leading design and rollout efforts for fintechs in Asia, I have found that gamification is a popular strategy among fintech players, but its implementation is frequently lacking.

It would be easy to just add a few badges and rewards, but that just doesn’t cut it. To get the most and improve your metrics, you are going to have to tailor your approach to make the most of gamification.

There is ample evidence to support the effectiveness of gamification. A survey conducted by Finances Online found that fintech apps can increase conversion rates by up to 700%. This means that users are more likely to interact with the app and continue using it.

Gamification is not only beneficial for engagement, but it also helps with user onboarding. Typically, only 15% of users complete the digital onboarding process. However, Shine, a French fintech company, has achieved an impressive 80% success rate by using gamification in their onboarding process.

Below, I will be running through some of the best practices that have proven success metrics that not only help you increase your engagement rates but also add a touch of delight to finance apps, which are often presented to users in the form of tables and numbers.

1. Goals and Challenges

Games become addictive because they present a challenge to players. If a game is too easy, it quickly becomes boring, and players are likely to quit.

Fintech apps can leverage this same idea for their app’s gamification strategy. Introduce a goal that users need to work towards.

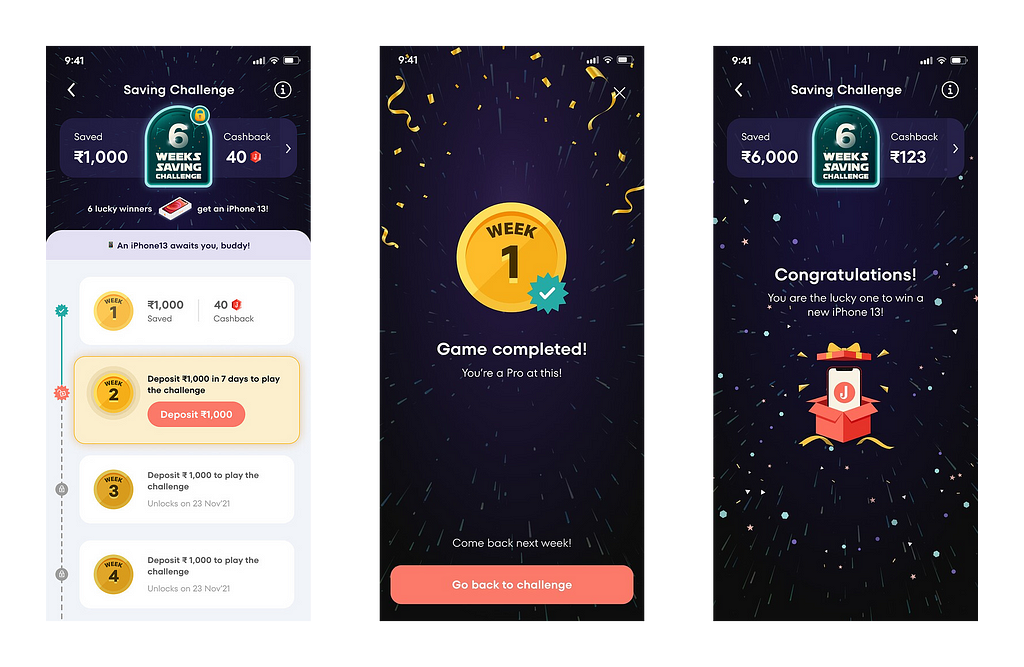

Jupiter launched a savings challenge that encouraged users to keep adding money to their accounts and setting it aside in a pot to motivate them to stay and be more likely to achieve their savings goal. The progress bar provided a means of visually tracking their progress through gamifying the budgeting and saving process. They also incentivized users with additional rewards, such as in-app Jewels, and the possibility of winning a new iPhone.

2. Educational Content

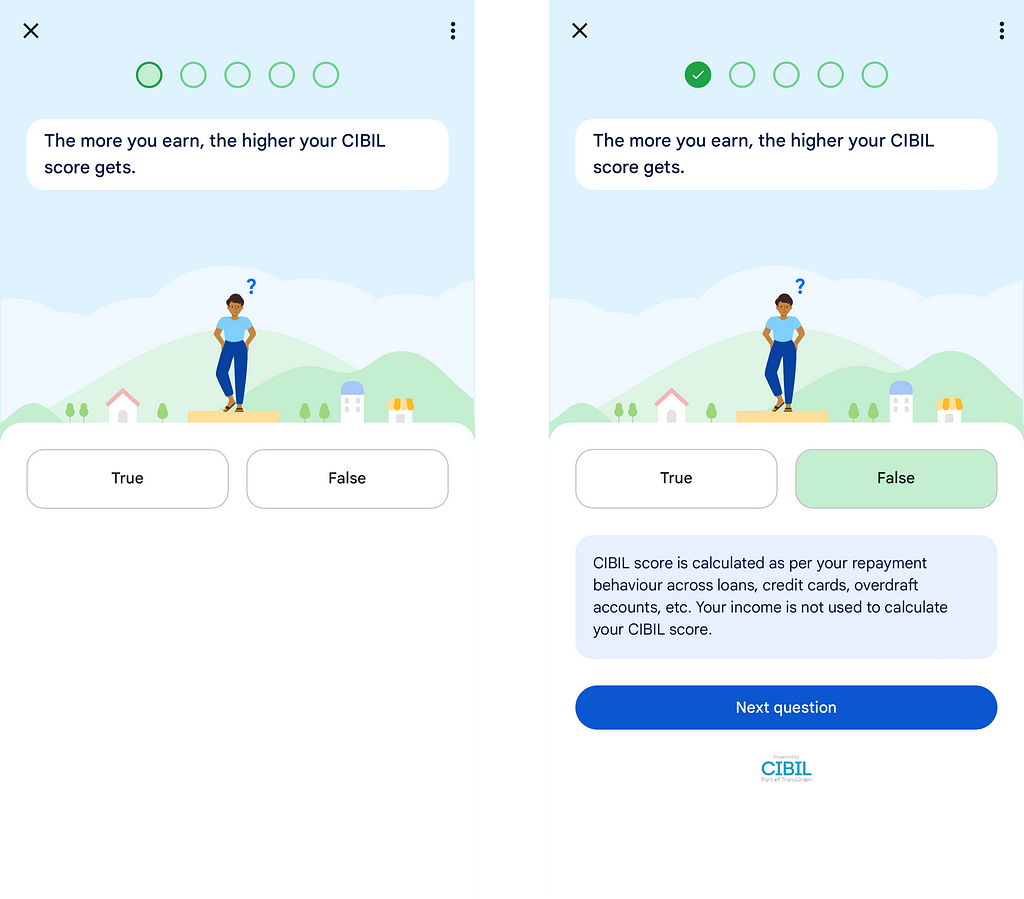

An underutilized approach to educating users about financial concepts involves incorporating educational games. Utilizing quizzes and interactive exercises, apps like Google Pay in India (see example below) offer users a gamified experience to learn about topics such as CIBIL credit scores and learn how to improve and manage their credit scores better.

This interactive method not only enhances user understanding but also makes the learning process engaging and accessible. By integrating interactive elements into the platform, users can not only improve their financial health but also better engage with your platform

3. Games and Rewards

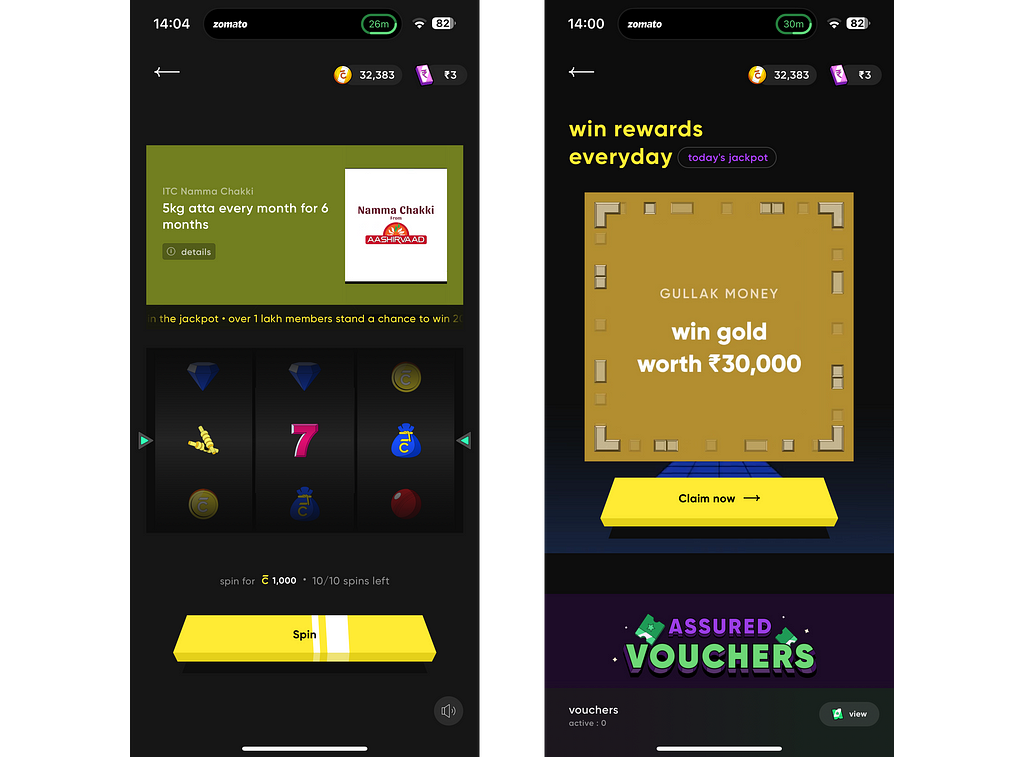

CRED, a fintech company in India that helps with credit card payments, uses gamification to make its app more fun for users. In the CRED app, there’s a section where users can earn rewards, and one of the popular features is a game that works like a slot machine. Users can play this game for free and have a chance to win Cred coins or other prizes.

By using a game format like slot machines, CRED gets users into the habit of coming back to the app regularly. When users play, they see the possible rewards they could win, which builds excitement as they watch the reels spin. This keeps users engaged with the app every day.

4. Progress bars and goal-setting

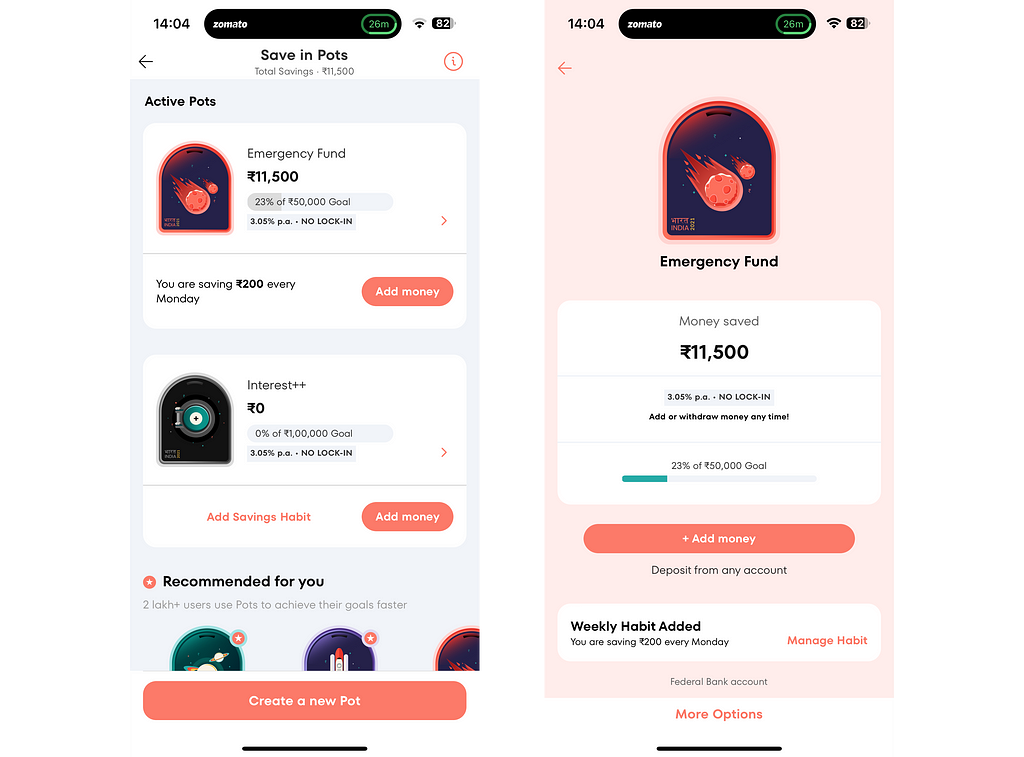

When it comes to managing money, it’s important for people to feel in control. Nobody wants to feel like their savings are being controlled by something they can’t see. That’s why apps like Jupiter offer features like “Pots,” which help users save for specific goals. Users can name their savings pots whatever they want and set custom goal amounts. Progress bars then show users how close they are to reaching their financial goals, providing a clear and motivating visual representation of their progress.

Wrap up

As the fintech space keeps growing and evolving, we have come to realize that although users’ finances are very important to them, it is not always easy to keep some user cohorts interested or educated, and this is where gamification in the fintech experience thrives, as it allows to offer a rewarding experience not just for the user by keeping them engaged but for the business as well.

Fintechs can thrive by applying these gamification engagement practices, as it not only improves user engagement and generates positive app ratings while simultaneously transforming the mundane finance task into an experience that adds delight to the user’s day and keeps them coming back.

Stay, Play, Save: Best Practices for Gamification in FinTech was originally published in UX Planet on Medium, where people are continuing the conversation by highlighting and responding to this story.