We all have habits, some good and some bad. Not to worry; this article isn’t about your habits but about helping you build positive habits like saving. Human wants are insatiable. We want to buy everything from fragrances to dinner with friends to traveling the world. In an article published by Barclays customers are looking for ways to spend more wisely to offset growing living costs. contactless payment has made it convenient for many people to lose track of how much money they have spent or have in their accounts. Generally, people might not be overlooking the importance of saving. However, external factors such as a lack of discipline and confidence regarding what little money people have to save often prevent them from doing so.

Behavioral science and persuasive techniques can offer valuable insights and practical strategies to bridge the gap between intention and action. In this article, we will be exploring principles of behavioral science that make saving money easier and more effective. In this article, we’ll explore how two renowned frameworks, Robert Cialdini’s Principles of Influence and BJ Fogg’s Behavior Model.

Understanding the Basics of Behavioral Influence

Understanding why saving is so hard is essential before looking into strategies. People frequently place more value on short-term gains (like spending money) than long-term gains (like financial security). We can create systems that gently sway judgments and match actions with long-term objectives to combat this.

Cialdini’s Six Principles of Persuasion

Cialdini outlined six principles that explain how to persuade people. Here’s how each principle can be applied to develop better saving habits:

Reciprocity

People feel obliged to reciprocate gifts or favors. By providing modest incentives or bonuses for creating savings accounts or keeping deposits, banks and financial platforms can promote saving. Some apps reward users with bonus interest or cashback for consistent savings contributions. On some saving apps it is completely free to create an account, creating a sense of reciprocity from the users to use the app

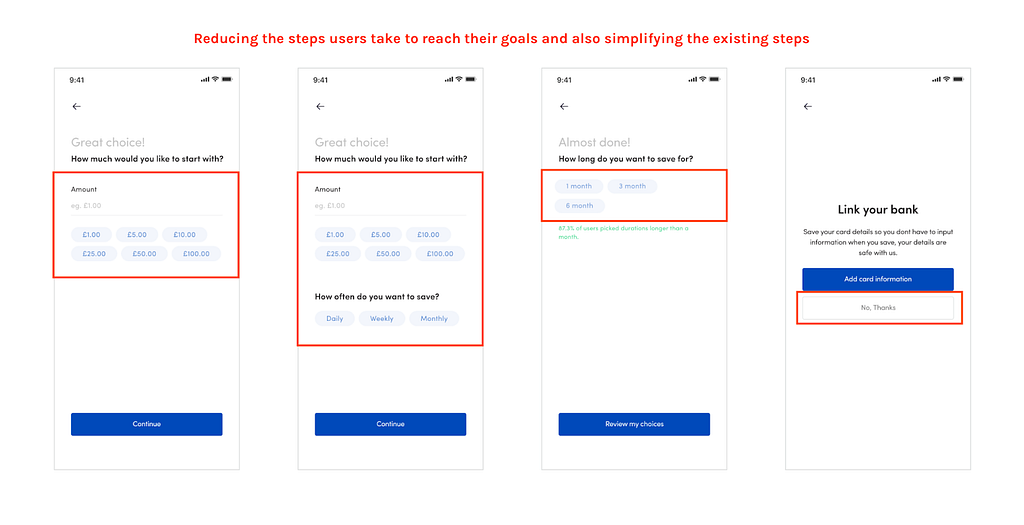

Commitment and Consistency

We are most likely to commit and be consistent when we have a goal in mind. If you have a goal and decide to save towards that goal it’s most likely you will be consistent and committed. Apps make use of visual reminders, like charts or apps, to track your progress and reinforce your commitment. Another way is by Automating savings contributions to ensure consistency

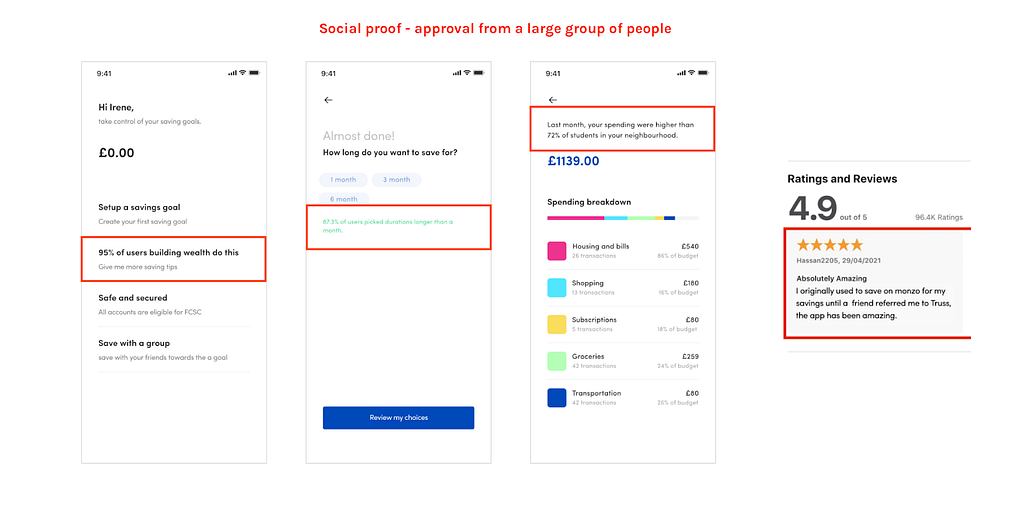

Social Proof

We tend to emulate the behavior of others, especially those we admire. Most apps provide simple statistics according to users’ spending and savings habits that are tied to what the general users are accomplishing in the same category. Joining a savings group or online community to see other users achieving their goals, encourages you to do the same. Social proof can also be in the form of ratings & reviews as reviews from existing users.

Authority

We trust advice from those we perceive as knowledgeable. When it comes to savings and financial applications, a trusted authority like the Financial Services Compensation Scheme (FSCS) and the Financial Conduct Authority (FCA). Recommends an app or savings method, you’re more likely to try it.

Liking

We’re more likely to act when we like or feel connected to someone. Apps have features that allow you to save with your friends thus making it easy to save. Most saving apps are user-friendly, engaging, and gamified to make saving enjoyable.

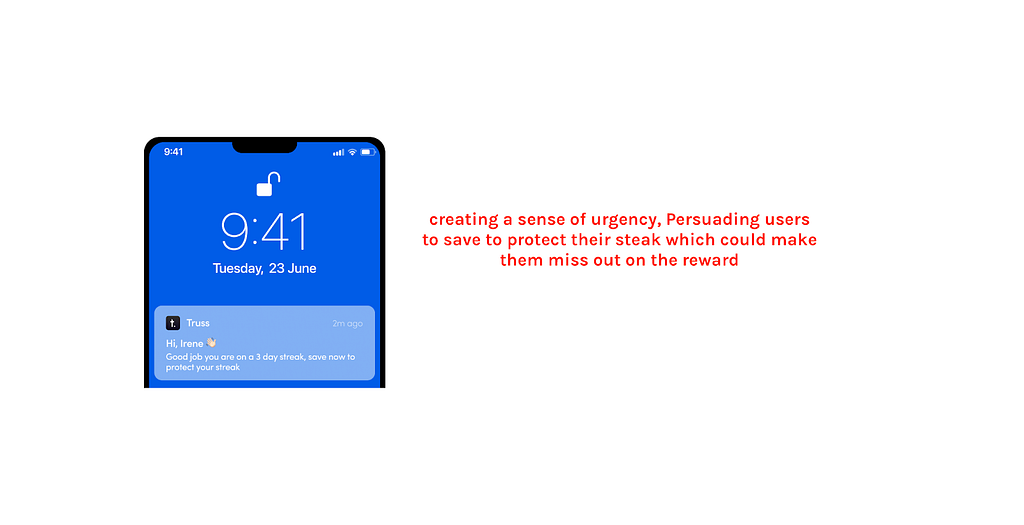

Scarcity

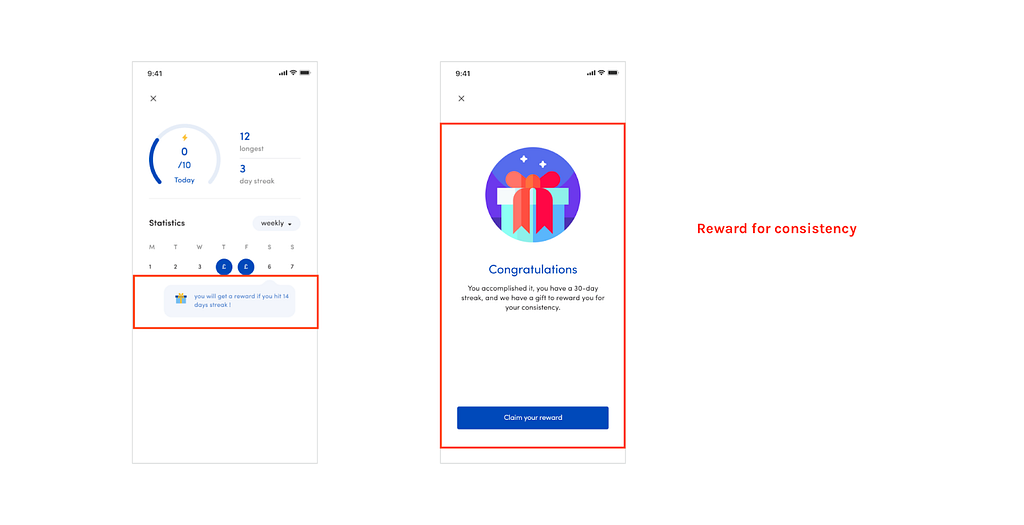

We value things more when they seem limited. This persuasion technique is implemented on most apps by creating a sense of urgency not to lose users’ savings streak, which could make users miss out on the reward (another form of persuasion technique). Another method is to Highlight the exclusivity of certain saving opportunities (e.g., “Save now to access higher interest rates”).

Fogg’s Behavioural Model

Dr. BJ Fogg’s behavioral model focuses on creating behavior change through motivation, ability, and triggers. He proposed the functional triad, which is three basic ways users view or respond to computing technologies; Primary Task Support, Dialogue Support, and System Credibility Support.

Computers as Persuasive Tools: Primary Task Support

This aspect of the Functional Triad emphasizes how technology simplifies or supports the primary task — in this case, saving money. By making saving more accessible and less cognitively demanding, individuals are more likely to engage consistently.

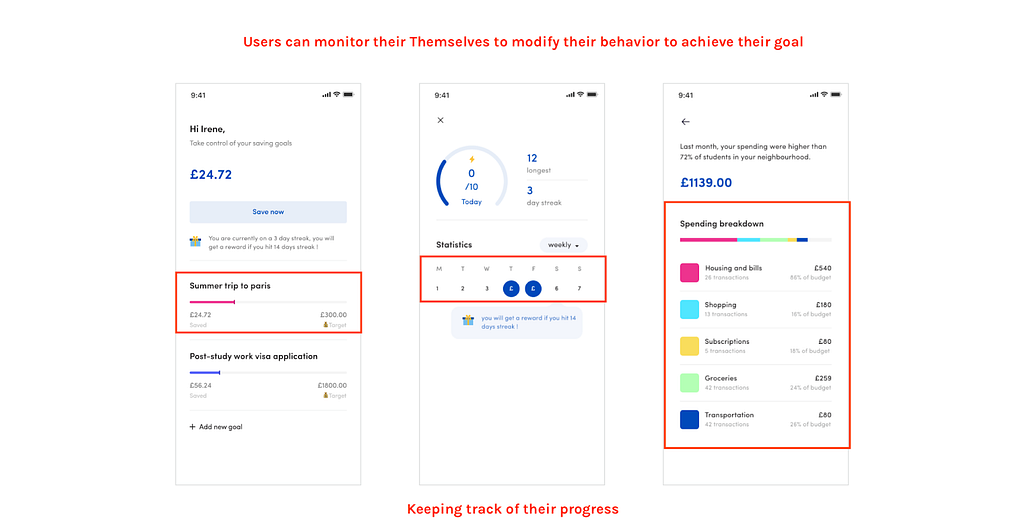

Self-monitoring

Tracking your behavior can feel tedious. To reduce such feelings, Fogg advises self-monitoring. Most saving apps have features that users can use to monitor and modify their savings progress to reach their intended goals, increasing the likelihood that they will continue to stick to the behavior.

Chunking Goals

Breaking down complex activities like onboarding, and and and intimidating savings targets (e.g., $12,000 per year) into smaller, manageable chunks (e.g., $1,000 per month or $250 per week) reduces overwhelm as Reduction influences users to perform the targeted behavior.

Computers as Persuasive Media: Dialogue Support

This aspect of the Functional Triad emphasizes how technology interacts with users through feedback, reminders, and rewards to encourage ongoing engagement. Saving money often requires sustained motivation, and dialogue support ensures the behavior stays top of mind. As we know from usability heuristics, Users expect systems to be interactive and provide feedback based on their usage.

Feedback

Immediate feedback about savings progress is a powerful motivator. Apps can provide daily, weekly, or monthly summaries showing how much a user has saved and how close they are to reaching their goals an example is a weekly notification congratulating a user on saving 80% of their monthly target, reinforcing the behavior with a sense of accomplishment.

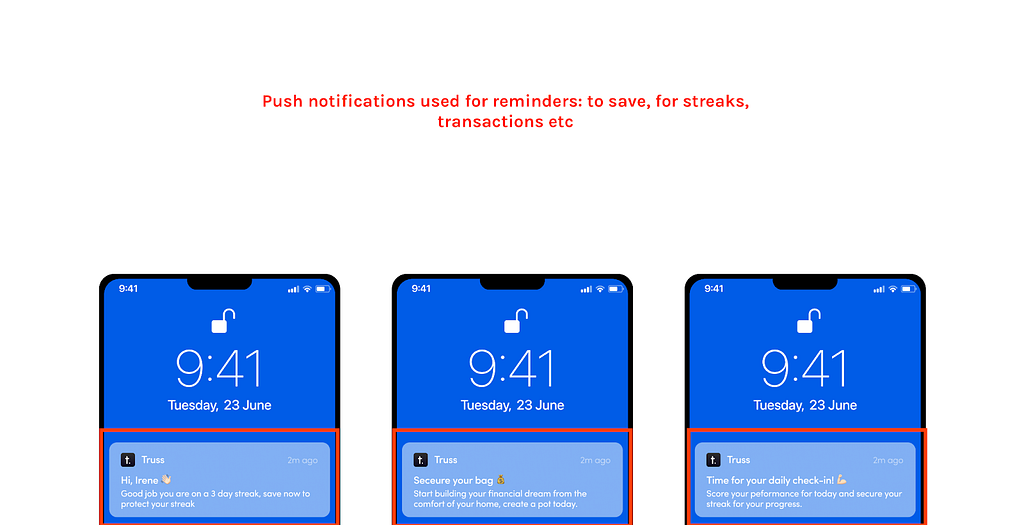

Reminders

According to Fogg, If a system reminds users of their target behavior, the users will be more likely to achieve their goals. Notifications are gentle prompts that encourage action at the right time. Apps can use reminders to notify users to make deposits, continue streaks, or celebrate milestones. For instance a notification like “Great job! You’ve saved $200 this month—just $50 more to hit your goal!” keeps the user engaged and motivated.

Positive Reinforcement

When users accomplish their intended goals, they experience a sense of accomplishment. Gamified benefits, such as earning badges for meeting milestones or completing streaks, may make saving more enjoyable and rewarding. For example, a user receives a badge for saving $500 in one month, as shown on their profile. This gamification creates a sense of accomplishment and motivates them to strive for the next award.

Conclusion

It takes a lot of preparation and user research to utilize behavioral and persuasive techniques to change people’s behavior for the better; you need to understand users, their context of usage, and their pain points to apply these techniques correctly. Developing better-saving practices is not only a personal task; it’s also a chance for financial institutions, developers, and designers to produce user-centered products that promote sound financial practices. We can make saving more rewarding and natural for users by incorporating Fogg’s behavioral model and Cialdini’s principles of persuasion into financial and saving applications. Small behavioral changes over time, such as automating deposits, commemorating achievements, or utilizing peer pressure, can result in significant financial gain.

Long-term success for financial products and services is fuelled by the alignment of behavioral science and user experience, which benefits users as well as fostering trust, loyalty, and happiness. Developing systems that combine motivation, accessibility, and persuasion is not only a design problem but also a societal need in a society where financial habits and literacy have a significant influence on people’s quality of life. With the help of Cialdini and Fogg’s ideas, Design practitioners can change things.

Wow, you made it to the end! Thank you for joining me on this journey. If you found this article helpful, inspiring, or just plain interesting, let your claps do the talking (the more, the merrier!). Each clap fuels my creativity and helps this piece reach more amazing readers like you. Let’s keep the conversation going — thanks for your support!

The application of Persuasive and Behavioral Techniques to Improve Saving Habits was originally published in UX Planet on Medium, where people are continuing the conversation by highlighting and responding to this story.